Monedas fiat

Criptomonedas

No hay resultados para ""

No pudimos encontrar nada que coincida con su búsqueda. Vuelva a intentarlo con un término diferente.

What is Bitcoin (BTC) Dominance?

Bitcoin was the first viable digital and decentralized cryptocurrency to emerge, and it remains one of the world's most reputable cryptocurrencies. Bitcoin has a massive influence on the entire crypto market due to its massive market capitalization.

Since the cryptocurrency market is highly volatile, it can be a risky investment. As a result, traders and investors are increasingly developing new tools and indicators to track market trends and make sound trading decisions.

The "Bitcoin dominance index" is one of these tools. The Bitcoin dominance index assists in analyzing various market conditions in order to determine which market trend is stronger between Bitcoin and altcoins.

What Is Bitcoin Dominance?

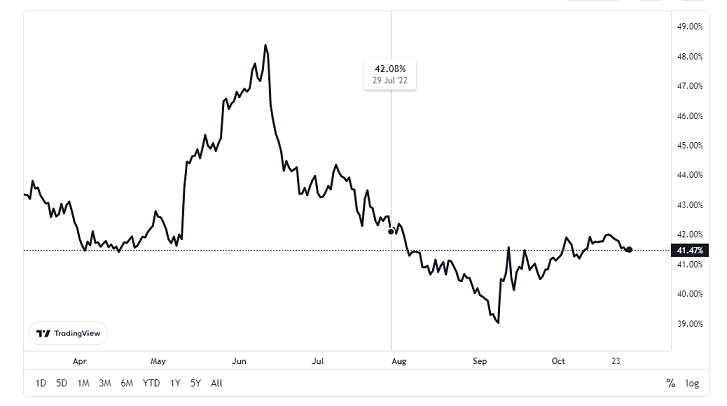

Source: (https://www.tradingview.com/symbols/BTC.D/)

Bitcoin dominance, or BTC dominance, is the percentage of total cryptocurrency value that is made up of Bitcoin. Its basic premise is that as BTC's dominance grows, the value of altcoins decreases. In contrast, as BTC's dominance declines, the value of altcoins rises. The Bitcoin dominance index and ratio are other names for BTC dominance.

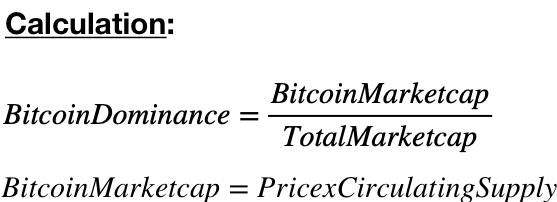

By comparing Bitcoin's total market capitalization to the combined total of all other cryptocurrencies, one can gauge the extent of Bitcoin's dominance. The term crypto market capitalization refers to the total market value of cryptocurrencies. The market capitalization of a cryptocurrency is determined by multiplying the total number of coins in circulation by their current price.

Bitcoin Dominance and Market Capitalization

For instance:

Market Cap: $1,027,087,928,735

BTC Marketcap: $385,387,896,829

BTC Dominance: 37.6%

Bitcoin dominance is defined as the ratio of Bitcoin's total market capitalization divided by the total market capitalization of the crypto market.

Bitcoin has the most sway over the cryptocurrency market because it was the first and most widely accepted form of cryptocurrency. As a result, the total crypto market cap follows the trend established by the market capitalization of Bitcoin.

The total crypto market cap follows the shape and direction of Bitcoin's market cap. Bitcoin's dominance over the entire market is so strong that anyone with even a basic understanding of cryptocurrency would consider Bitcoin their first investment choice. As a result, any new investment is bound to increase Bitcoin's market capitalization.

Key Factors Affecting Bitcoin (BTC) Dominance

New Cryptocurrencies Launch

New coins that enter the market can sometimes gain popularity quickly, causing BTC's dominance to diminish. Remember that bitcoin is "fighting" with every other cryptocurrency on the market, so the simultaneous emergence of several popular altcoins may have an impact on it. However, these altcoins may lose popularity once the hype wears off. If this occurs, and funds are transferred from these altcoins to BTC or out of the crypto market entirely, BTC's dominance may return.

Changing Trends

Bitcoin dominance reached its peak of 95% in 2017 given the lack of competition from other cryptocurrencies. In early 2018, due to the ICO boom and the rising popularity of other blockchains like Ethereum, Terra, and Solana, BTC dominance fell to an all-time low of 37.64%.

While bitcoin was created to change the way money was transferred, crypto projects have evolved to do more. Unlike bitcoin, many altcoins are involved in industries other than money transfer, such as gaming, art, and decentralized financial services. Depending on the current trend, a specific type of crypto project may generate more interest and trading. For example, the proliferation of Gamefi may have caused BTC dominance to wane in favor of Gamefi-related tokens.

Bull or Bear Market

Altcoin popularity rises during a bull market. This causes investors to divert profits from BTC holdings purchased during the previous bear run and invest them in altcoins, NFT projects, and riskier assets in the hope of seeing large returns. This undermines BTC's dominance.

In bear markets, on the other hand, BTC dominance typically increases as investors seek to reduce risk. Most investors are hesitant to hold volatile altcoins and prefer to invest in less volatile assets such as Bitcoin.

Closing Thought

BTC dominance can be used to shed light on how market cycles are changing. It is used by some traders to fine-tune their trading strategies, while others use it to manage their diverse portfolios. It should be noted that BTC dominance does not guarantee the performance of bitcoin or any other cryptocurrency, but rather serves as a guide to help traders plan their trading strategy.

Stay tuned to CoinCarp Social Media and Discuss with Us:

Twitter |Telegram |Reddit |Discord

$30,000 Deposit Blast-Off

Sponsored

Earn up to $30,000 when you make your first deposit and trade on Bybit! Register Now!

- Appchains: The Next Evolution in Blockchain TechnologyPrincipiante 2m

- PFP (Profile Picture) NFTs: Unlocking Digital Identity and CreativityPrincipiante 2m

- Soft Money vs. Hard Money: Decoding Currency Types and Their ImpactPrincipiante 2m

- Bitcoin Stamps: A Secure and Immutable Addition to the Crypto LandscapeIntermedio 2m