Devise fiat

Crypto-monnaies

Aucun résultat pour ""

Nous n'avons rien trouvé qui corresponde à votre recherche.Réessayez avec d'autres mots-clés.

How to Download Tax Forms 1099-MISC and 1042-S

Binance.US provides customers with the ability to easily access and download their tax documents so they may better prepare for tax season. This walkthrough answers basic questions about forms 1099-MISC and 1042-S and where to access them on the Binance.US mobile and desktop platform.

To learn more about cryptocurrency tax reporting, visit our Cryptocurrency Tax Reporting 101 page.

What is Tax Form 1099-MISC

Tax form 1099-MISC is a tax form Binance.US is required to provide to all customers who earned $600 or more from staking or referral rewards in 2022. This form will only appear if you have met such requirements and will be made available to you January 21, 2023.

What is Tax Form 1042-S

Tax Form 1042-S applies to all eligible non-US customers who have earned $600 or more from staking or referral rewards in 2022. This form will only appear if you are a non-US customer who has met such requirements and will be made available to you March 3, 2023.

How Do I Find and Download These Forms?

Follow these steps to export your 1099-MISC or 1042 on the Binance.US platform.

- On the mobile app

- On the web

On the mobile app

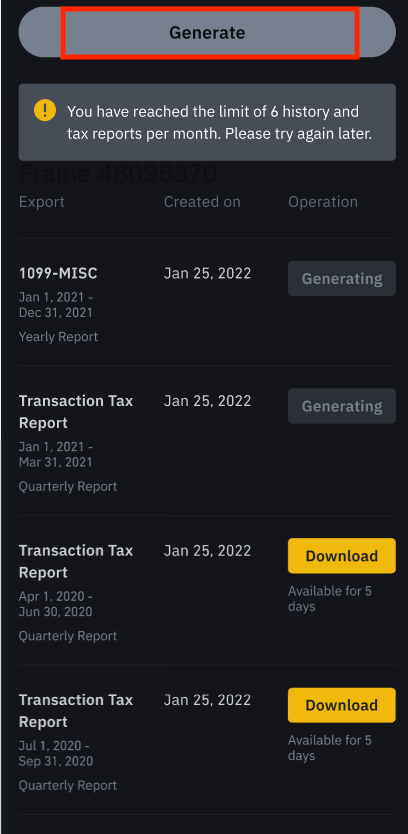

*The mobile app will only provide the .PDF version of your report. For .CSV exports, please use the web.

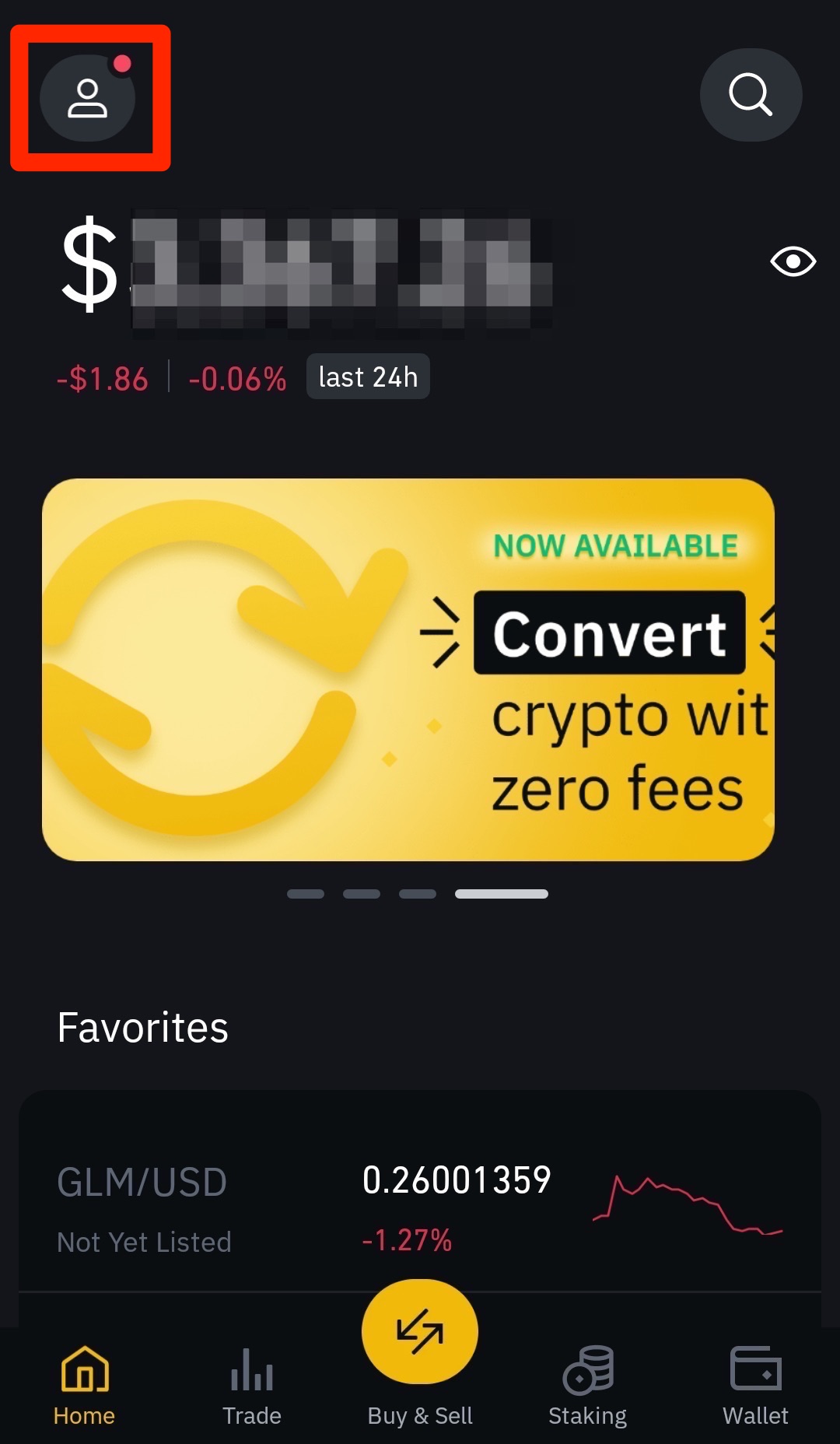

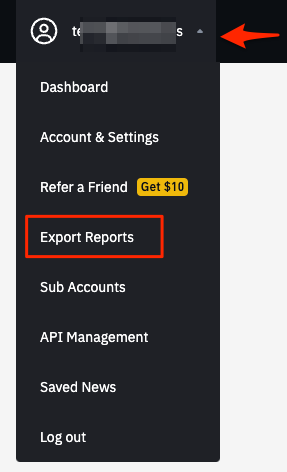

1. Tap the Profile Icon in the top-left corner of your app.

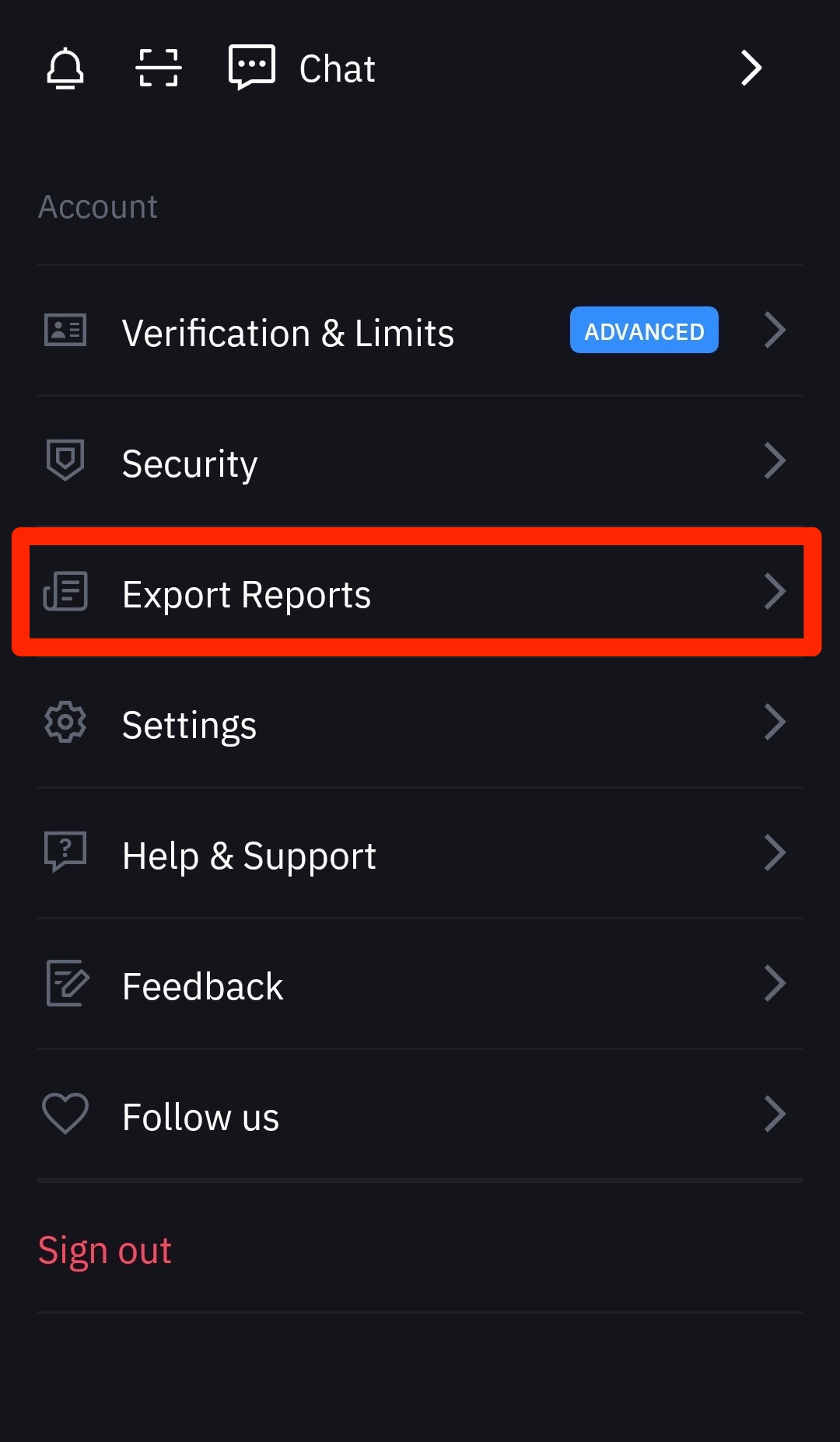

2. Scroll down to the 'Account' section and select 'Export Reports.'

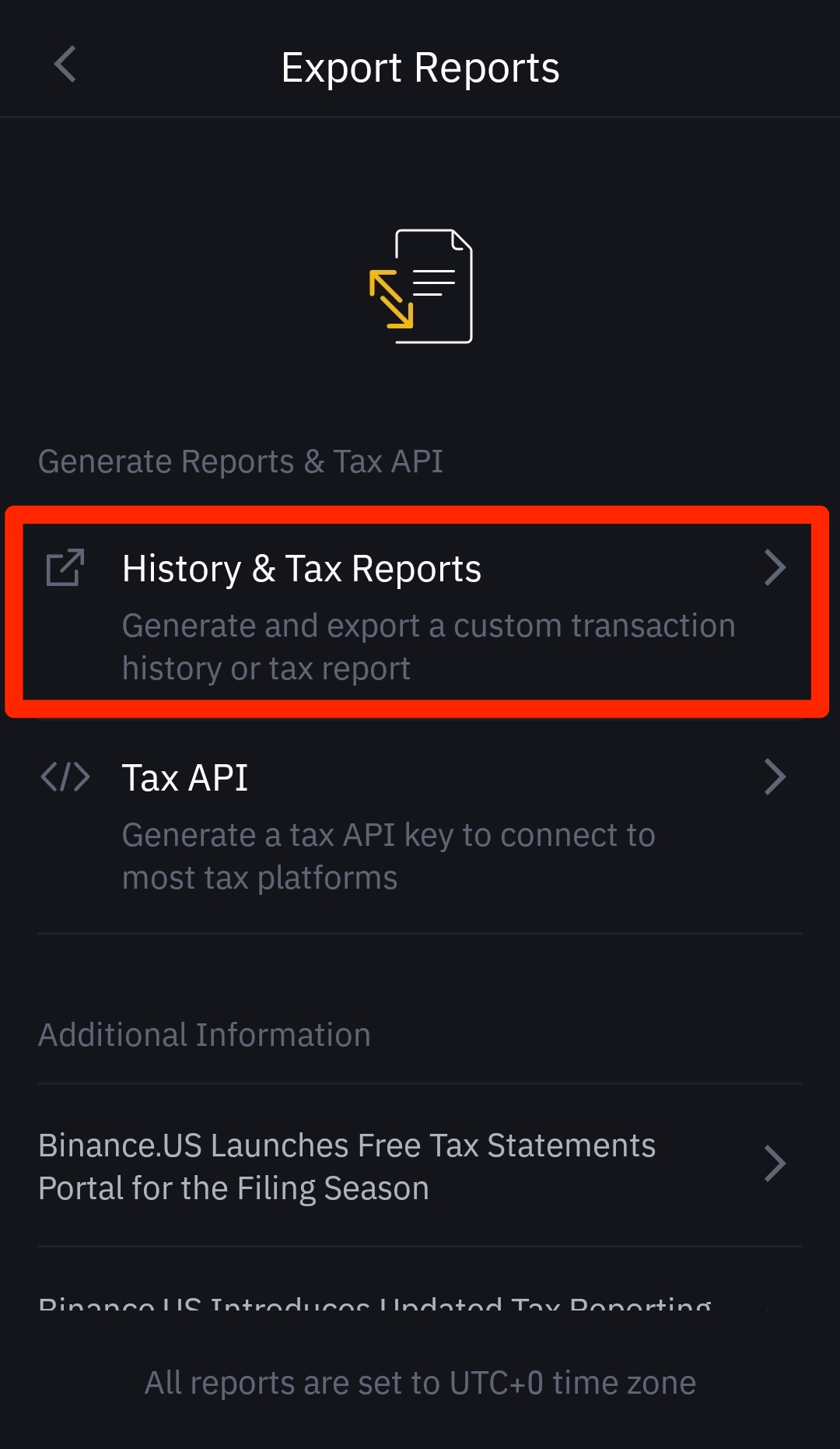

3. Tap 'History & Tax Reports.'

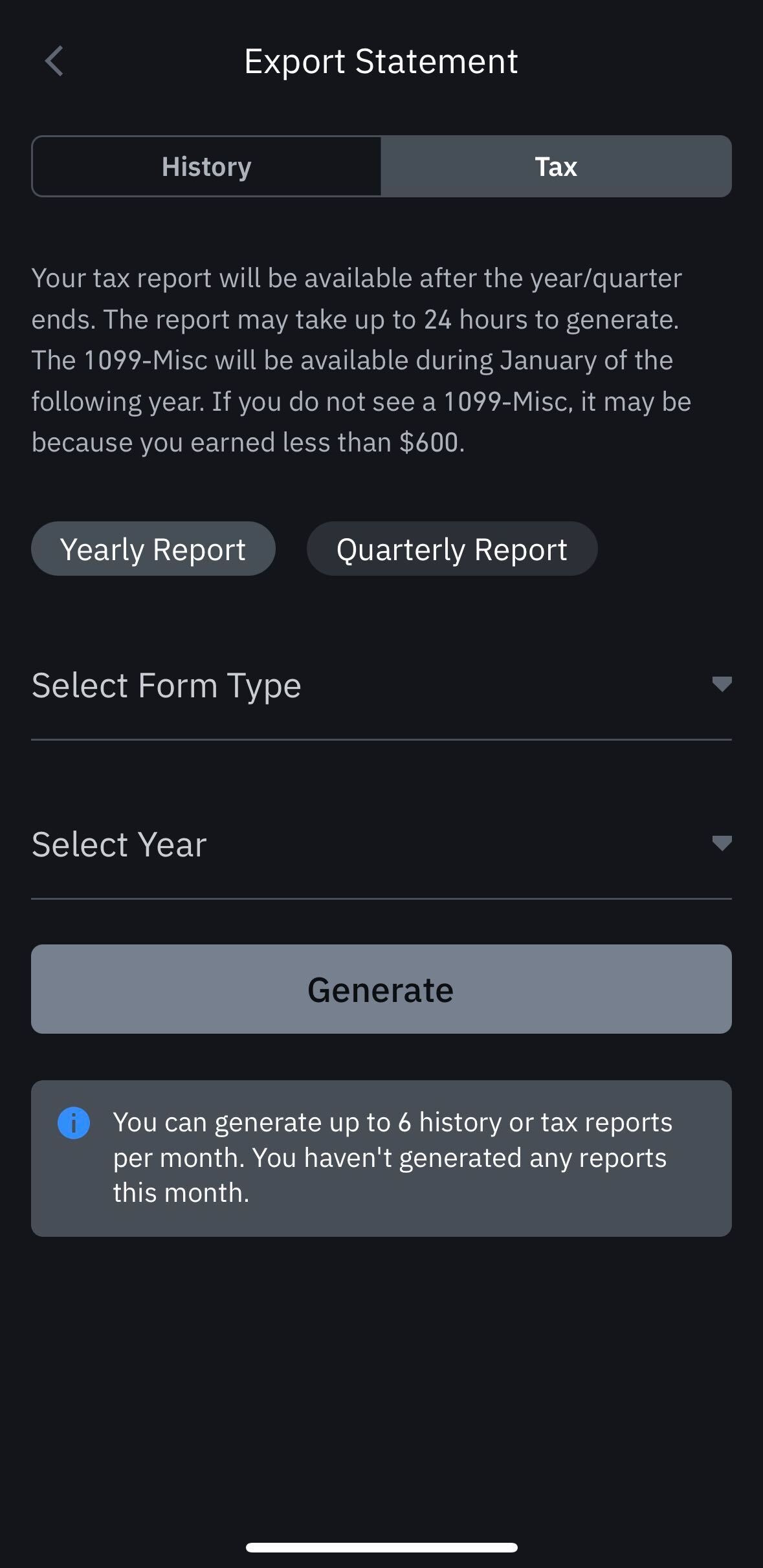

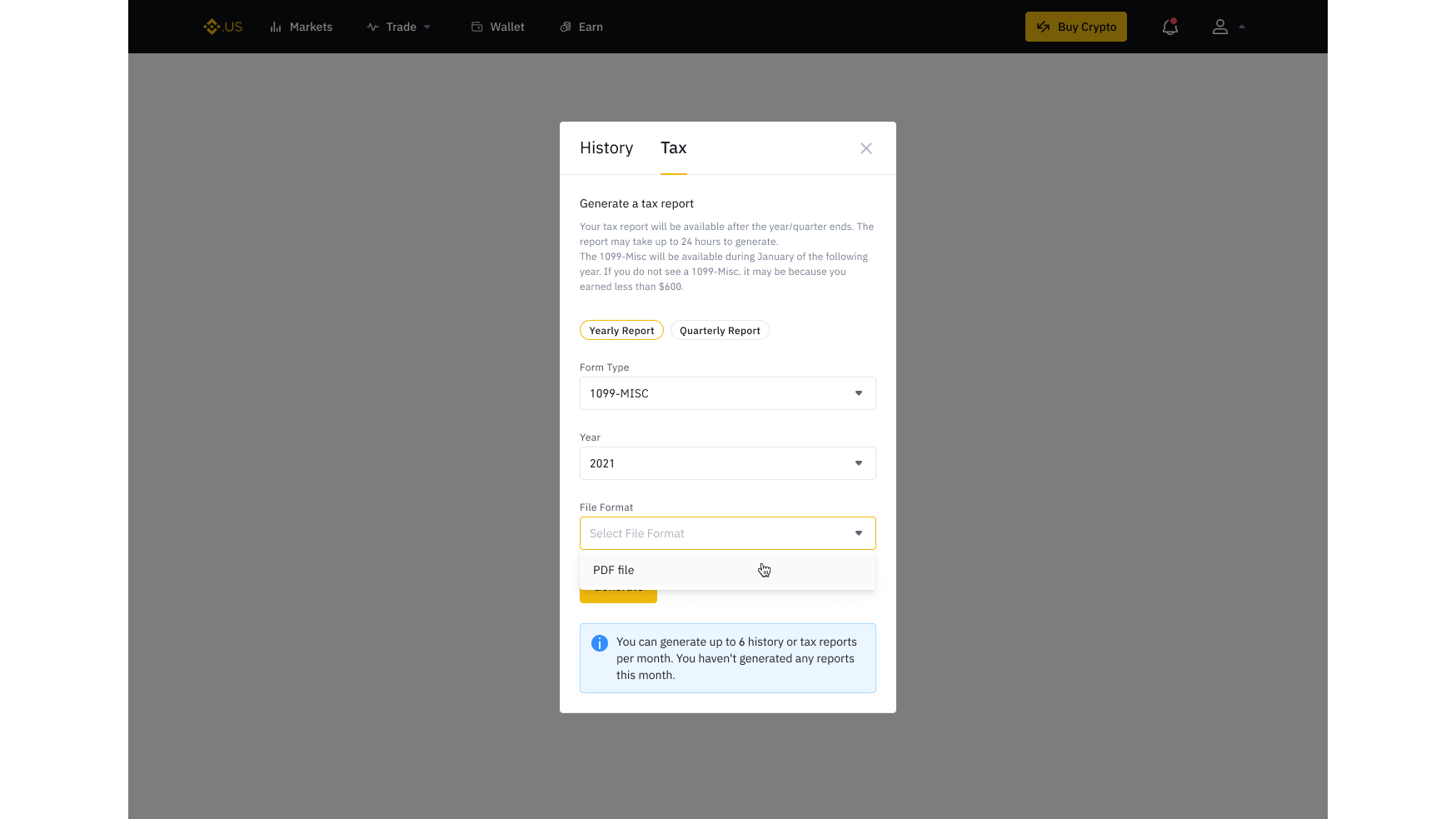

4. Select the tab that says 'Tax', located at the top-right side of your mobile screen. Yearly Report will be preselected.

5. Tap Select Form Type and choose 1099-MISC. This option will only appear if you have met the necessary trading requirements. (1042-S will only be an option only for non-U.S. residents). Choose the year from the Select Year dropdown menu. Once selected, press Generate and your form will be added to the queue.

On the web

Exporting your report from the web will allow you to choose between .PDF and .CSV files.

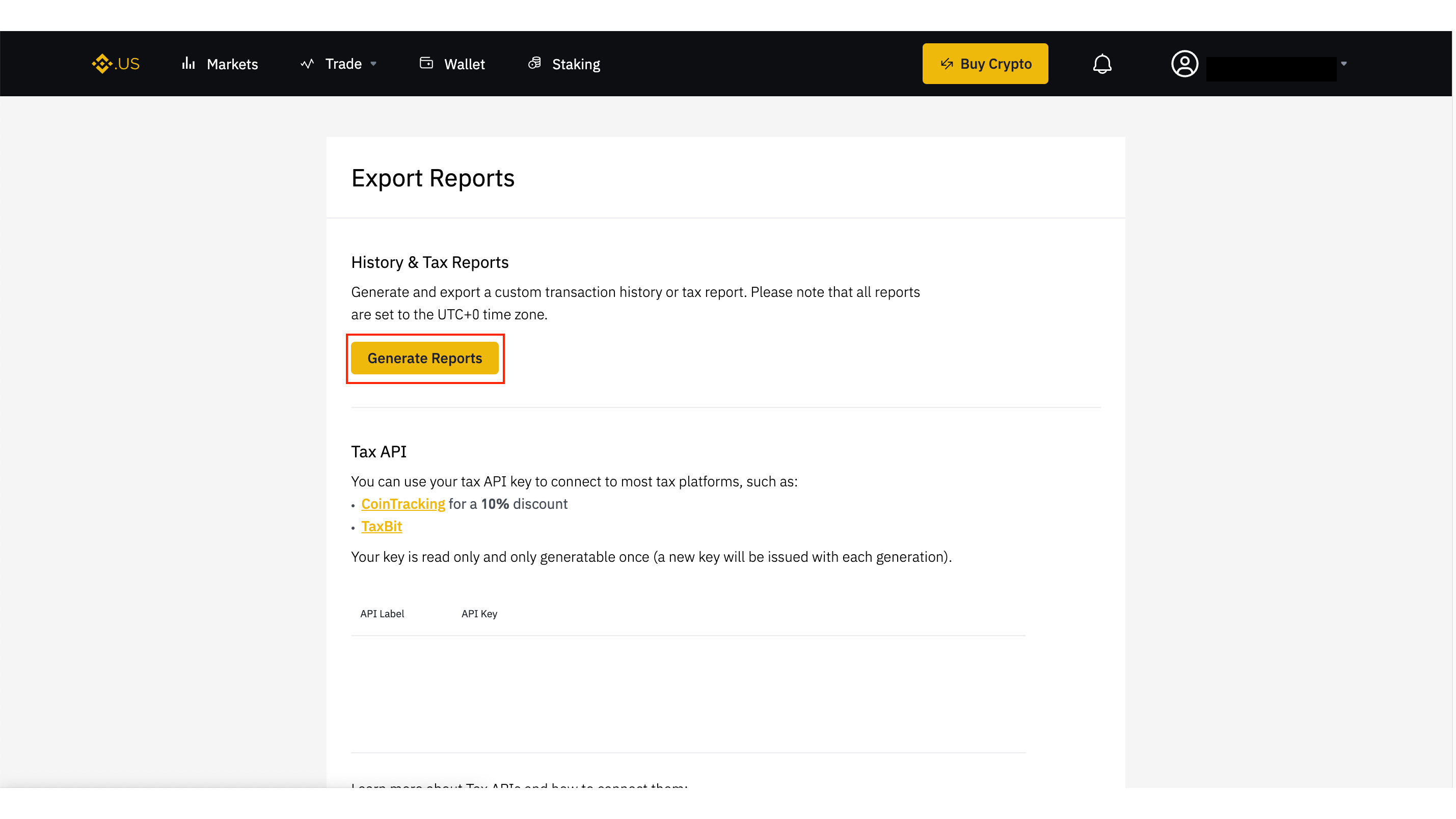

1. Log in to your Binance.US account. Then, hover over the User Profile button in the top-right corner and click Export Reports from the drop-down menu. Alternatively, you can access the Export Reports page from your Wallet by clicking the Export Reports link in the top-right corner.

2. Click Generate Reports to continue.

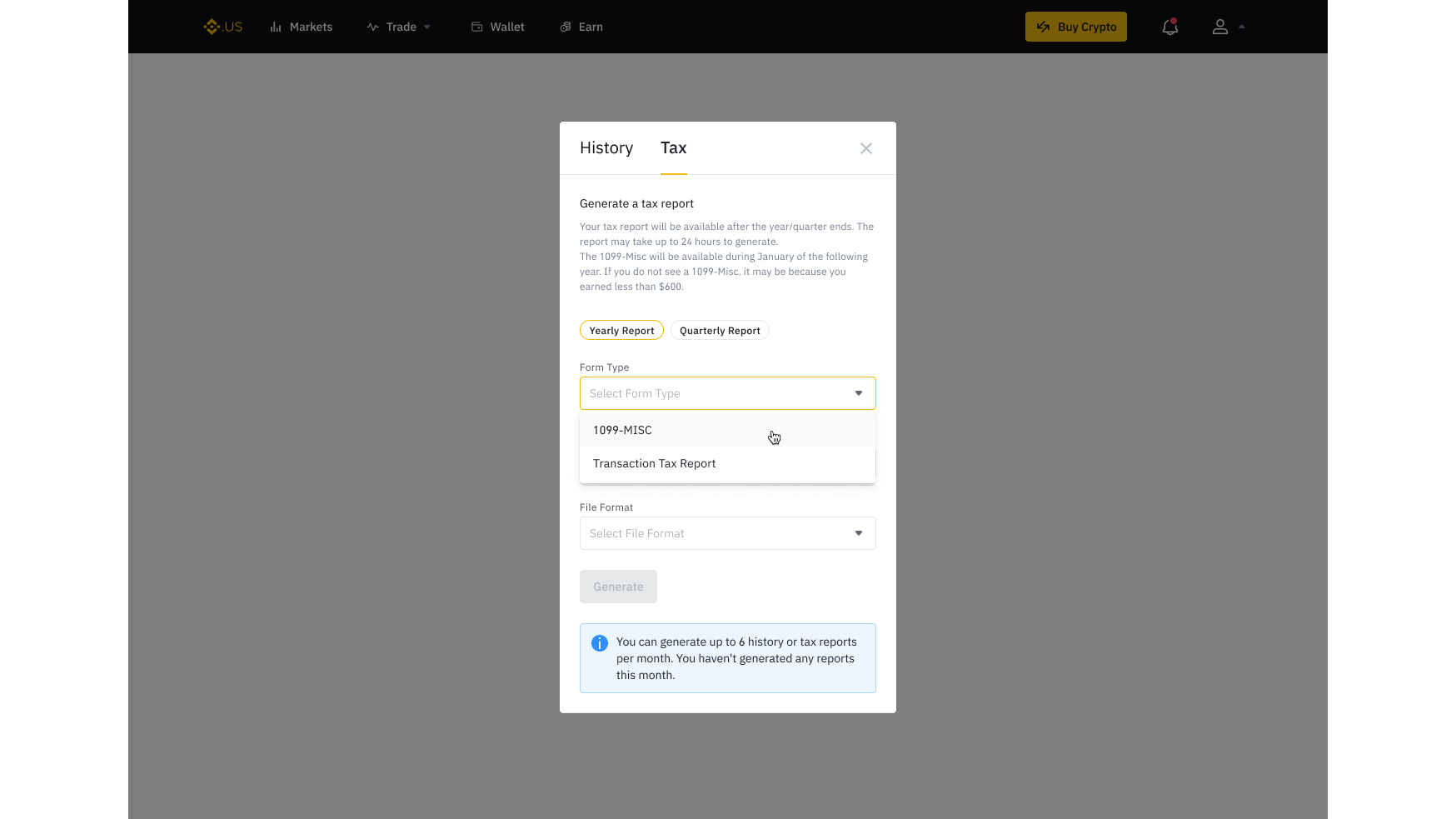

3. Click the Tax tab located at the top of the pop-up below and select 1099-MISC from the Select Asset drop dropdown. (1042-S will only be an option only for non-U.S. residents).

4. Select the year you would like to view the file format from the respective dropdown menus. Click Generate and your file will be added to the queue. There is a download limit of 6 tax reports per month.

Additional Resources

- Tax Landing Page

- Cryptocurrency Tax Reporting 101(FAQ)

- Binance.US Introduces Updated Tax Reporting Tool(Blog)

Download the Binance.US app to trade on the go: iOS|Android

Follow us on social media to stay up to date with Binance.US news and announcements:

Telegram

Legal disclaimer: This material has been prepared for general informational purposes only and should NOT be: (1) considered an individualized recommendation or advice; and (2) relied upon for any investment activities. All information is provided on an as-is basis and is subject to change without notice. We make no representation or warranty of any kind, express or implied, regarding the accuracy, validity, reliability, availability or completeness of any such information.Binance.US does NOT provide investment, legal, or tax advice in any manner or form. The ownership of any investment decision(s) exclusively vests with you after analyzing all possible risk factors and by exercising your own independent discretion. Binance.US shall not be liable for any consequences thereof. Please consult an outside tax professional for guidance on your personal tax obligations.

Risk warning: Buying, selling, and holding cryptocurrencies are activities that are subject to high market risk. The volatile and unpredictable nature of the price of cryptocurrencies may result in a significant loss. Binance.US is not responsible for any loss that you may incur from price fluctuations when you buy, sell, or hold cryptocurrencies. Please refer to ourTerms of Use for more information.

$30,000 Deposit Blast-Off

Sponsored

Earn up to $30,000 when you make your first deposit and trade on Bybit! Register Now!