명목화폐

암호화폐

해당 결과 없음 ""

검색에 일치하는 항목을 찾을 수 없습니다.다른 용어로 다시 시도하십시오.

DEX Aggregators: What They Are and How They Work

If you are interested in trading or investing in cryptocurrencies, you may have heard of decentralized exchanges (DEXs). These are platforms that allow you to swap tokens without the need for a central authority or intermediary. You can enjoy more security, privacy and control over your funds on DEXs, as well as access a wide range of innovative and diverse projects in the decentralized finance (DeFi) space.

However, DEXs are not without their challenges. One of the main issues is liquidity, which refers to the availability and depth of trading pairs on a platform. Liquidity affects the speed, price and efficiency of your trades. If a DEX has low liquidity, you may face high slippage, which is the difference between the expected price and the actual price of a trade. You may also encounter high fees, slow transactions and limited options.

This is where dex aggregators come in. Dex aggregators are financial protocols that give you an easy way to access various trading pools from a single dashboard. They use sophisticated algorithms to find the best possible provider for a specific token swap across multiple DEXs. By using a dex aggregator, you can save time, money and hassle when trading on DEXs.

In this article, we will explain what dex aggregators are, how they work and what are some of the benefits and drawbacks of using them. We will also introduce some of the top dex aggregators in the market and how to use them.

What is a DEX Aggregator?

A dex aggregator is a platform that sources liquidity from different DEXs and offers you the best token swap rates than you could get on any single DEX. A dex aggregator acts as a bridge between you and multiple DEXs, allowing you to access a deeper pool of liquidity with a single click.

A dex aggregator's main task is to offer you better swap rates than any specific DEX can offer and to do that in the shortest possible time. Other major tasks are protecting you from price impact, reducing the probability of failed transactions and minimizing the fees.

A dex aggregator works with algorithms that consider different factors before selecting the best possible provider for a specific token swap. Some of these factors are:

- The price of the token pair on different DEXs

- The liquidity depth and availability of the token pair on different DEXs

- The slippage rate and price impact of the trade on different DEXs

- The fees charged by different DEXs and the dex aggregator itself

- The gas cost and speed of the transaction on different DEXs

- The complexity and efficiency of the trade route on different DEXs

Based on these factors, a dex aggregator may split your trade across several DEXs to get you an overall better price than a single swap on any one exchange. For example, if you want to swap ETH for UNI, a dex aggregator may route your trade through multiple DEXs such as Uniswap, SushiSwap and Kyber Network to find the optimal balance between price, liquidity and fees.

How Does a DEX Aggregator Work?

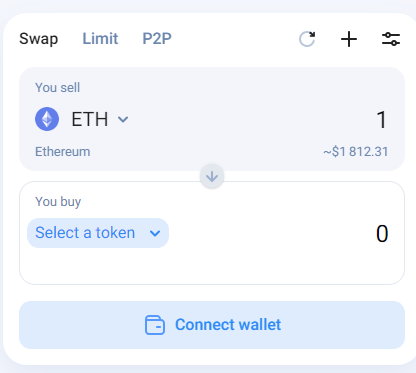

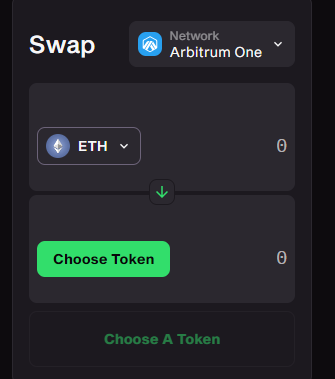

To use a dex aggregator, you need to connect your wallet to its platform. You can use any compatible wallet such as MetaMask, Trust Wallet or Ledger. Once you connect your wallet, you can select the token pair that you want to swap and enter the amount that you want to trade.

The dex aggregator will then scan multiple DEXs for the best swap rate and show you a list of platforms offering the best value for your trade. You can also see other details such as slippage, fees and gas cost. You can compare different options and choose the one that suits your needs.

Once you confirm your trade, the dex aggregator will execute it on your behalf through smart contracts. Depending on the complexity of the trade route, it may involve multiple transactions across different DEXs. You will receive a confirmation message once your trade is completed.

What are Some Benefits of Using a DEX Aggregator?

Some of the benefits of using a dex aggregator are:

- You can access more liquidity and better prices than any single DEX

- You can save time and hassle by using one platform instead of multiple ones

- You can reduce slippage, fees and gas cost by optimizing your trade route

- You can discover new and innovative projects and tokens on different DEXs

- You can enjoy more security, privacy and control over your funds on DEXs

What are Some Drawbacks of Using a DEX Aggregator?

Some of the drawbacks of using a dex aggregator are:

- You may still face high fees and gas cost due to network congestion and demand

- You may still encounter low liquidity and price impact for some tokens and pairs

- You may still face failed transactions due to technical issues or market volatility

- You may still need to do your own research and due diligence before trading any token or project

- You may still need to trust the dex aggregator and its smart contracts

What are Some of the Top DEX Aggregators in the Market?

There are many dex aggregators in the market, each with its own features, advantages and disadvantages. Some of the top ones are:

- 1inch: 1inch is one of the most popular and advanced dex aggregators in the market. It supports trades across major ecosystems like Ethereum, Binance Smart Chain, Polygon, Arbitrum and Optimism. It gives you access to over 120 liquidity sources, with 68 on Ethereum, 39 on Binance Smart Chain and 24 on Polygon. It also has its own DEX and governance token called 1INCH. It has a user-friendly interface, detailed documentation and a well-developed help center.

- Slingshot: Slingshot is a dex aggregator that works on Ethereum-based protocols such as Polygon and Arbitrum One. It gives you access to over 326 exchanges and liquidity sources. It also offers features such as limit orders, price alerts and portfolio tracking. It has a simple and sleek interface, but it is still in beta mode and may have some bugs or issues.

- ParaSwap: ParaSwap is a dex aggregator that supports trades on Ethereum, Polygon, Binance Smart Chain and other networks. It gives you access to over 75 liquidity sources, including DEXs, lending platforms and market makers. It also offers features such as gas token integration, fiat on-ramp and API access. It has a fast and responsive interface, but it may charge higher fees than some competitors.

- Matcha: Matcha is a dex aggregator that supports trades on Ethereum, Binance Smart Chain and Polygon. It gives you access to over 50 liquidity sources, including DEXs, AMMs and RFQs. It also offers features such as limit orders, price charts and analytics. It has a smooth and intuitive interface, but it may have lower liquidity than some competitors.

Conclusion

Dex aggregators are platforms that help you find the best swap rates across multiple DEXs with a single click. They can help you save time, money and hassle when trading on DEXs. However, they also have some drawbacks such as fees, gas cost, failed transactions and trust issues. Therefore, you should always do your own research and due diligence before using any dex aggregator or trading any token or project.

Stay tuned to CoinCarp Social Media and Discuss with Us: