명목화폐

암호화폐

해당 결과 없음 ""

검색에 일치하는 항목을 찾을 수 없습니다.다른 용어로 다시 시도하십시오.

What Is Bitcoin Dominance?

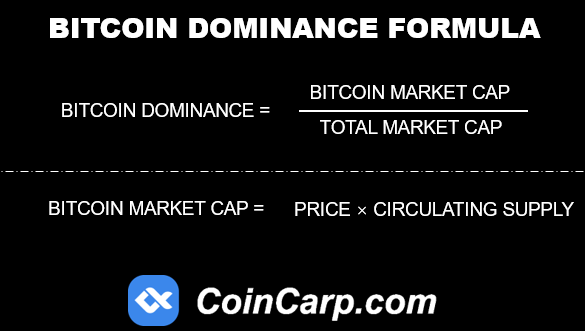

The market capitalization (market cap) of Bitcoin is the largest among all cryptocurrencies, comprising a significant portion of the trading volume and attention in the crypto markets. When we look at the combined market cap of all existing cryptocurrencies, we can calculate the total market cap for the entire crypto sector. This ratio between Bitcoin's market cap and the rest of the crypto markets is known as the Bitcoin dominance.

What Is Bitcoin Dominance?

Bitcoin Dominance is the ratio between Bitcoin's market cap and the rest of the crypto markets. To calculate Bitcoin dominance, one must take the current market capitalisation of Bitcoin (e.g. US$538 billion at the time of writing) and divide it by the global crypto market capitalisation (e.g. US$1.2 trillion). Doing so yields a percentage of 44.8%, which represents the share of the crypto market cap held by Bitcoin.

For many years, Bitcoin had a near total control of the cryptocurrency market. But its dominance has significantly dropped as new cryptocurrencies have been created, likely due to the surge in popularity of ICOs after Ethereum and the ERC-20 token standard were introduced.

What Is Bitcoin Dominance Right Now?

The total market capitalization of Bitcoin is currently estimated to be around US$540 billion. This is calculated by multiplying the current market price, which is US$27, 952, by the total number of bitcoins in circulation, which is 19.3 million. The maximum amount of bitcoins that can ever exist is 21 million. Now the global crypto market capitalisation is US$1.2 trillion, at the time of writing. So Bitcoin's dominance is currently 44.8%.

If you want to check the live Bitcoin Dominance right now, you can find it on CoinCarp Global Charts.

Why Does Bitcoin Dominance Matter?

The Bitcoin Dominance Index (BDI) allows crypto traders to track Bitcoin's relative influence on the rest of the crypto market. It is typically used in conjunction with other data sets to help identify potential trading opportunities, manage risks, and spot market trends. As Bitcoin makes up the majority of the crypto market cap, it has typically been highly correlated with altcoins, which react strongly to its price movements. As a result, many suggest that tracking Bitcoin dominance can help to understand trends in the altcoin market. As the total number of altcoins increases and the crypto markets become more diverse, the dominance of Bitcoin appears to be declining steadily. These shifts and changes in Bitcoin's dominance are of particular interest to traders, as they may be used as a guide when analyzing multiple metrics and determining the ideal trading strategy.

The crypto Fear and Greed Index relies on data sources, one of which is Bitcoin dominance. This metric looks at whether fear or greed is the driving force in the market, and can indicate whether certain assets are trading higher or lower than their true value. Generally, an increase in Bitcoin dominance indicates fear in the market, whereas a drop in dominance can signal the start of an altcoin season - a period of time when multiple altcoins experience a surge in price against both the dollar and Bitcoin. As these altcoins become more profitable, Bitcoin's market share and dominance are reduced. Additionally, traders use Bitcoin dominance to make buy-and-sell decisions, such as with a strategy that uses dominance to find the strongest trend.

Closing Thought

It is important to remember that Bitcoin dominance is not indicative of its actual value, due to the presence of premined and forked coins that ultimately affect the total market cap in an artificial way. Furthermore, market cap does not mean money flowing into the market; it is simply a measurement of the circulating supply and current market price. When Bitcoin was the only available cryptocurrency, its dominance was close to 100%; however, with the increasing number of new cryptos on the market, this number has decreased. Nonetheless, this should not be viewed as a bad or good thing; Bitcoin dominance is merely a tool that can help us gain insight into the changing landscape of the crypto space.

Stay tuned to CoinCarp Social Media and Discuss with Us:

$30,000 Deposit Blast-Off

Sponsored

Earn up to $30,000 when you make your first deposit and trade on Bybit! Register Now!