Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

Trade Smarter: Discover the Unique Perks of KuCoin Cross Margin

What is Cross Margin mode?

Cross Margin is a margin mode that uses the full available balance in a user’s account as collateral for all open positions under the same margin mode. This includes unrealized profits and losses from other positions, enabling more efficient capital utilization.

Features:

Profit and Loss Sharing: All funds and unrealized profits or losses across positions under Cross Margin are pooled together, which helps lower the risk of liquidation.

Adaptable to Long-Term Holdings and Volatile Markets: Provides greater flexibility to manage large market swings, making it suitable for long-term strategies and trading highly volatile assets.

Exclusive Advantages of KuCoin Cross Margin

No Tiered Risk Limits

KuCoin Cross Margin adopts a traditional financial approach known as the no tiered risk limit model. This means that the more funds and leverage you apply, the larger the positions you can open — essentially, higher input leads to higher position size. The position limit depends solely on your margin amount, without a strict upper cap. Unlike other platforms that require frequent switching between risk limit levels, KuCoin’s Cross Margin offers a smoother, hassle-free trading experience that stands out.

Example:

A trader has a total margin balance of $10,000 in their account and wants to open futures positions using leverage.

On platforms with tiered risk limits, the trader might face predefined maximum position sizes that change as they increase leverage or funds, requiring them to manually switch risk levels or reduce position sizes to avoid hitting limits.

With KuCoin Cross Margin’s no tiered risk limit model, the trader can simply apply higher leverage to their margin, and their maximum allowable position size grows proportionally. For example:

At 10x leverage, the trader can open positions up to $95,000.

At 20x leverage, the trader can open positions up to $180,000.

There are no discrete caps or tier restrictions forcing the trader to switch between risk limit levels. This seamless scaling means the trader can freely adjust their position size based solely on available margin and desired leverage, enabling a smoother and more efficient trading experience.

Efficient Margin Allocation for Two Side Open Orders

The margin required for open orders is calculated based on the maximum exposure on either the long or short side. This method is particularly advantageous for market makers and high-frequency traders, as it ensures that when both long and short orders are placed, margin is only applied to the side with the greater exposure, thereby improving capital efficiency. Once an order is filled, the margin requirement is determined by the larger of the remaining open order margin and the position margin.

Example:

A trader places two open orders simultaneously:

A long order with an exposure of $100,000

A short order with an exposure of $80,000

Under KuCoin‘s Cross Margin’s margin mechanism:

The margin is only required for the side with the greater exposure, which is the long side at $100,000.

No margin is charged for the short side at this stage, which reduces overall margin usage.

Later, suppose the trader’s long order is filled and becomes an open position. At this point:

The margin requirement will be calculated based on the larger of:

The margin required for the remaining open short order ($80,000 exposure)

The margin required for the open long position ($100,000 exposure)

In this case, the margin would be based on the $100,000 exposure, as it is larger.

Streamlined Leverage Management:

On most exchanges, traders must frequently adjust leverage settings in response to changes in available funds to maintain their target position size. With KuCoin Cross Margin, leverage only needs to be set to the maximum once, enabling users to consistently open the largest allowable positions without the need for ongoing manual adjustments.

A Superior Solution for Liquidation and Maintenance Margin Requirements (MMR)

1) Challenges with multi-tier risk limits on many Exchanges

On many trading platforms, liquidation follows a tiered risk structure.

For instance, consider opening the largest permissible BTC position using $1 billion in funds with 2x leverage and a 48% maintenance margin rate (MMR). A mere 1% decline in price would trigger liquidation, forcing part of the position into the next risk tier with a lower 46% MMR. Even if the market subsequently recovers, the account’s equity cannot fully return to its original state, resulting in irreversible asset losses.

2) KuCoin Cross Margin’s dynamic MMR solution

Reduced liquidation risk: A maximum MMR of only 30%.

No tiered forced liquidation: As long as the overall risk ratio remains below 100%, normal market fluctuations do not result in asset losses.

Lower MMR requirements for major cryptocurrencies: Further decreasing the likelihood of liquidation and enhancing capital efficiency.

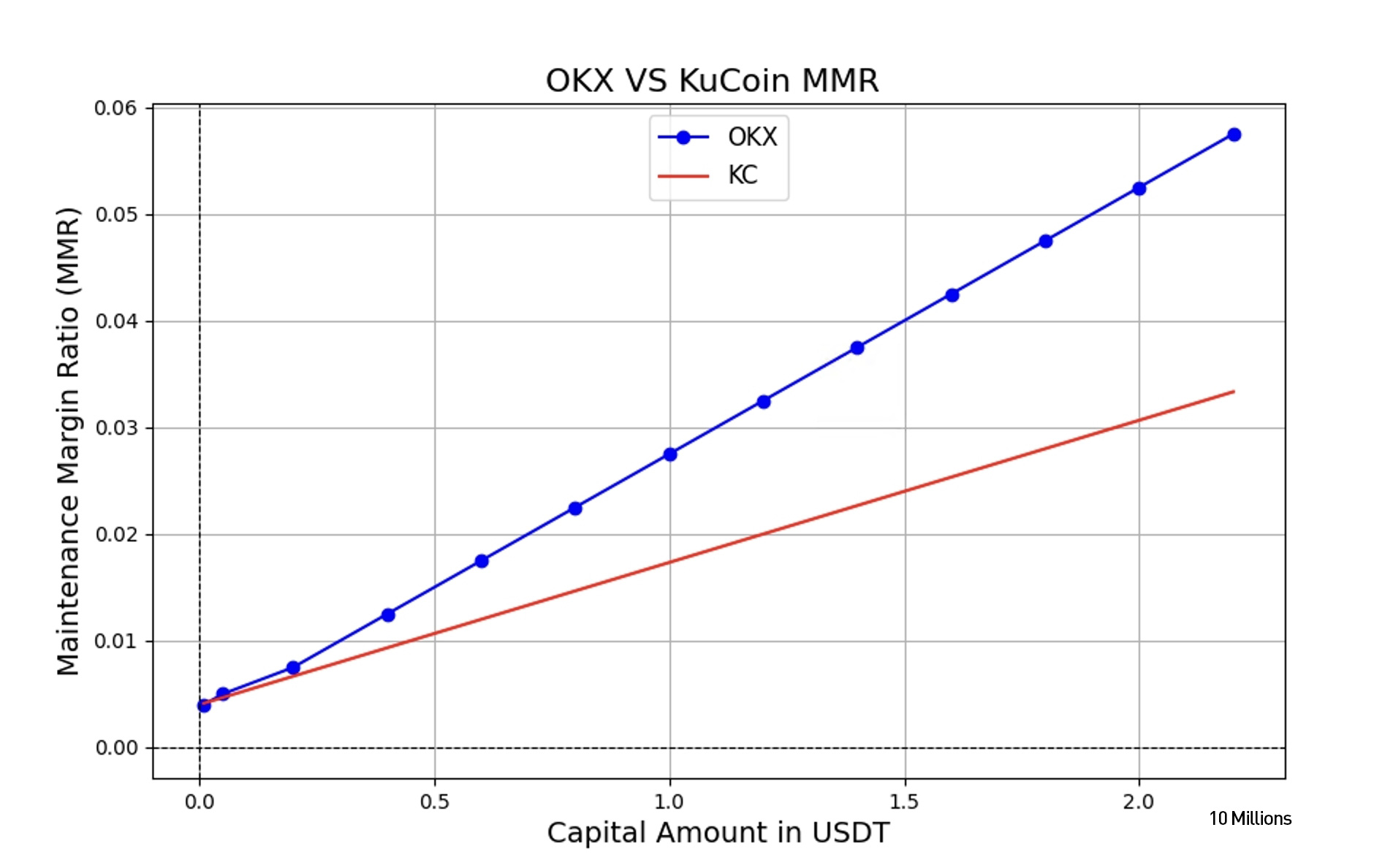

For most major cryptocurrencies, KuCoin Maintenance Margin Ratio (MMR) is lower under equivalent conditions, thereby reducing the risk of liquidation for users. Taking BTC as an example, the chart below presents the MMR at the maximum open position across various funding levels (data sourced from OKX’s official website):

Additional Resources on Cross Margin

What is Cross Margin mode?

Advantages of Cross Margin mode

Risk ratios of Cross Margin mode

Automatic deleverage in Cross Margin mode

Liquidation price of Cross Margin mode

Maximum position size in Cross Margin mode

How to Use Kucoin Futures Cross Margin Via API

Stay tuned to CoinCarp Social Media and Discuss with Us:

X (Twitter) | Telegram | Reddit

Download CoinCarp App Now: https://www.coincarp.com/app/