Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

Futures Stop-Limit

What is a Stop-Limit Order?

A stop-limit order allows users to close a position with pre-set trigger conditions (limit price or stop price). When the latest price, fair price, or index price reaches the pre-set trigger price, the system will close the position at the best market price according to the pre-set trigger price and quantity, hence achieving the goal to stop loss or take profit. This allows users to automatically calculate their ideal PnL and avoid unnecessary losses.

A stop-limit order may fail to be placed due to several reasons such as severe market fluctuations, insufficient liquidatable positions, and other system issues. The actual executed price may deviate from the pre-set price as a result of closing positions at the best market price.

The Importance and Value of Stop-Limit Settings

Why is the Stop-Limit Function So Important?

Every time an experienced trader opens a position, they must carefully consider their ideal limit price and stop price to avoid having their judgment affected by any market fluctuations.

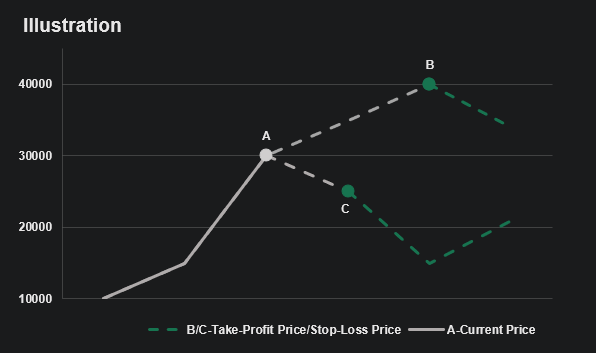

Example:

Assume you opened a BTC_USDT long position at the current price of 30,000 USDT (A). You can pre-set the trigger conditions for 40,000 USDT (B) as the limit price and 25,000 USDT (C) as the stop price.

- When the fair price of BTC/USDT futures reaches 40,000 USDT, the stop-limit order will be triggered and executed at the best market price, achieving a profit of 10,000 USDT.

- When the fair price of BTC/USDT futures reaches 25,000 USDT, the stop-limit order will be triggered and executed at the best market price, limiting loss to 5,000 USDT.

Stop-Limit Settings

Take Profit: Users may set their ideal minimum profit for a specific position by pre-setting the trigger price (latest price, fair price, or index price), PNL, or ROE.

Stop Loss: Users may set their maximum acceptable loss for a specific position by pre-setting the trigger price (latest price, fair price, or index price), PNL, or ROE.

There are two methods to set up a stop-limit order:

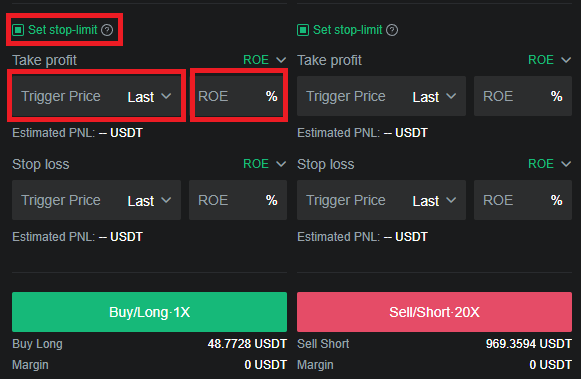

1) Setting up when opening a position (applicable in cross margin mode only)

This means setting up a stop-limit order in advance for the position that is about to be opened. When placing a limit order or market order, users may click on the [Set stop-limit] option, then set the trigger price based on the latest price, fair price, or index price. When the limit or market order is filled (partially or fully), the system will immediately execute a stop-limit order at the trigger price pre-set by the user.

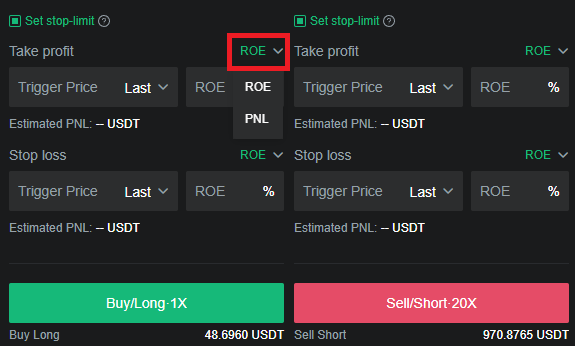

Users can choose from three types of profit and loss modes: trigger price, PNL, and ROE (as shown in the figure below). If the user chooses to set the stop-limit order based on ROE, the trigger price and the expected PnL will be calculated based on ROE, and vice versa.

Note: Although the system supports the use of ROE or PNL to set up a stop-limit order, the set ROE and PNL are for reference purposes only. The actual ROE and PNL may be affected by the processing fee, the change in average position opening price, and the actual execution price during a trade. Adding a position will cause the average position opening price to change, but since the stop-limit trigger price is determined at the time of creation, it will not change accordingly.

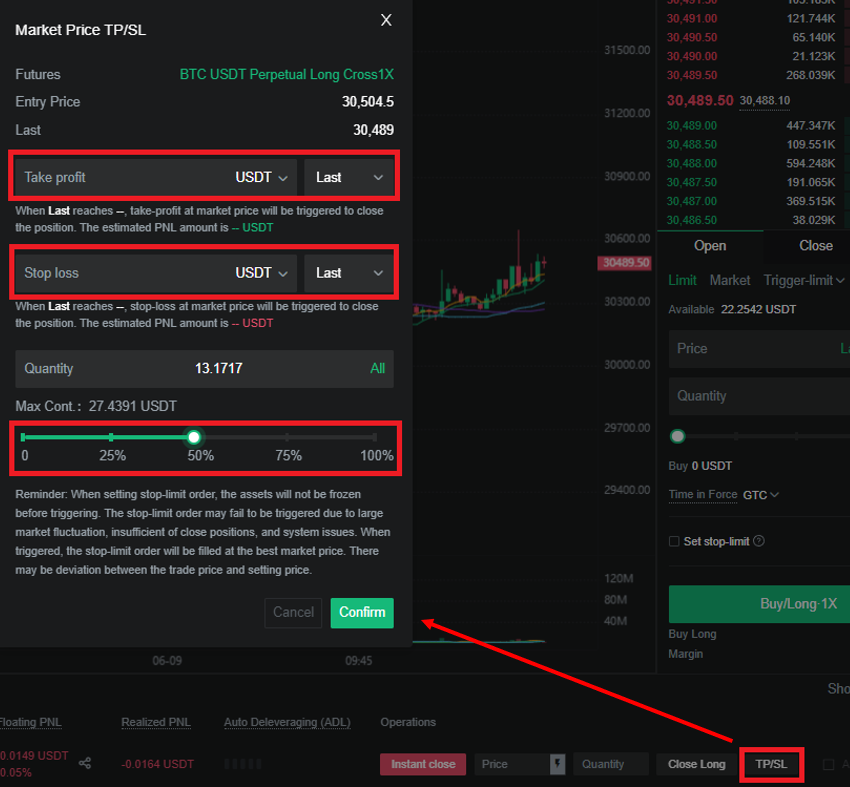

2) Setting up while holding a position (applicable in both isolated and cross margin modes)

If the user skipped over the stop-limit settings when opening a position, but wants to set it up after, the user can do so while holding the position. Users can set the limit price and stop price for the position separately or simultaneously. After the settings have been done, when the market price meets the trigger conditions, the system will place a stop-limit order according to the pre-set trigger price and quantity.

Users can click on [Stop-limit] in the currency of a currently held position, and set their desired stop-limit trigger price or ROE, or they can also set the trigger price and order quantity via stop-limit to close the position partially. This method is also applicable in isolated margin mode where stop-limit settings cannot be done at the time of opening a position, as well as for trigger limit orders and stop market orders.

Conclusion

By using a stop-limit order, users are able to minimize their losses and even gain greater profits.

Stay tuned to CoinCarp Social Media and Discuss with Us:

X (Twitter) | Telegram | Reddit

Download CoinCarp App Now: https://www.coincarp.com/app/