명목화폐

암호화폐

"" 해당 결과 없음

검색에 일치하는 항목을 찾을 수 없습니다.다른 용어로 다시 시도하십시오.

BNB's Breakout Year: What Its 2025 Performance Reveals About Where Crypto Value Is Accruing

The 2025 market effectively dismantled the long-held crypto maxim that high-tide liquidity lifts all assets equally. While the total cryptocurrency market capitalization contracted by 9.7%, erasing nearly $330 billion in value, capital did not flee the sector entirely. Instead, it concentrated.

BTC ended the yeardown 5.44%, ETH fell 10.97%, and SOL retraced 35.52%. BNB moved in the opposite direction. The asset surged 22.63%, climbing from $701.57 to $860.34 even as the broader sector corrected.

This divergence signals a fundamental repricing mechanism where market participants prioritized operational utility and settlement finality over speculative narrative. The liquidity flows of 2025 suggest that the market has begun to distinguish between assets that facilitate economic throughput and those that rely on transient momentum.

On-Chain trading activity as a demand driver

This outperformance stems less from speculative fervor and more from mechanical necessity. The launch of Binance Alpha 2.0 forced an acceleration in money velocity handling over $1 trillion in trading volume while onboarding 17 million users in 2025. These users needed the underlying asset to participate, creating immediate utility. Users required the token to engage in high-frequency economic events, effectively creating a demand floor that operated independently of broader macro sentiment.

"Alpha illustrates how the definition of 'trading on Binance' has changed from 'placing orders on an order book' to discovering new ecosystems," noted Yi He, Co-CEO of Binance, in the company's 2025 Year In Review report. She emphasized that this shift allows users to engage with Web3 "without losing the benefits of regulated infrastructure and deep liquidity that our platform offers."

This shift transformed holding the asset from a passive bet into an active income strategy. Data indicates that participating in ecosystem rewards, such as Launchpool and various holder airdrops, generated approximately $71.50 per coin in additional value. This created a yield component that cushioned volatility.

On-chain throughput on BNB Chain also hit an all-time high of 31 million daily transactions in October reinforcing the link between token value and network usage. The market effectively bid up the asset not because of what it might do in the future but because of what it was required to do in the present.

Stablecoin settlement and fee utility

The broader market contraction masked a significant expansion in the stablecoin sector, which effectively served as the year's primary utility driver. The global stablecoin market capswelled by 48.9% to $311 billion in 2025. Unlike memecoins or governance tokens that rely on attention economies, stablecoins require constant settlement finality. Blockchains acting as the settlement rails for this economy capture value through gas fees and liquidity requirements.

Within the BNB Chain ecosystem, the stablecoin market capitalization doubled to $14 billion at its peak. This utility extended to payments, where Binance Pay expanded to 20 million merchants. Lifetime volume for the service now stands at $280 billion.

Stablecoins dominated the flows in 2025, accounting for 98% of all B2C payment settlements. This data suggests the market is beginning to price infrastructure tokens based on their role in facilitating this economic throughput rather than purely on future technological promises. As the stablecoin economy expands, the networks that secure and settle this volume become the primary beneficiaries of the value accretion.

RWAs and institutional workflows

Institutional capital displayed a clear preference for regulated environments over experimental ones during the 2025 correction. Institutional trading volume on Binance grew 21% year-over-year, while OTC fiat trading surged 210%, indicating that larger market participants moved from testing phases to full integration. This migration heavily favored infrastructure capable of handling tokenized Real-World Assets (RWAs) within a compliant framework.

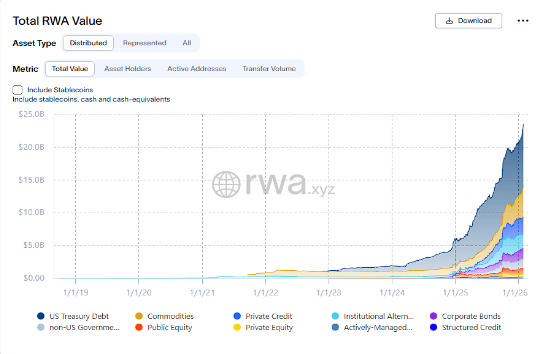

Data from RWA.xyz shows global tokenized RWA value grew 261% in 2025 to $20.65 billion. BNB Chain captured a portion of this, surpassing $1.8 billion in tokenized assets. Institutions are no longer just exploring blockchain technology; they are deploying capital where deep liquidity intersects with regulatory safety.

This inflow aligns with a broader industry push toward compliance. "The ADGM license crowns years of work to meet some of the world's most demanding regulatory standards," stated Binance Co-CEO Richard Teng regarding the exchange's regulatory milestones. He argued that the intersection of regulation and volume "shows that scale and trust need not be in tension: the more people trust the system, the more it grows."

Capital concentration in 2025 became a question of venue, not just asset. Institutions de-risked portfolios by moving liquidity into environments with regulatory clarity. Unregulated, experimental chains faced sharper drawdowns as the money left.

Tokens priced as infrastructure assets

The divergence between infrastructure tokens and speculative assets marks the end of the "rising tide" era. Wintermute reported that the median altcoin rally fell to 19 days in 2025, a significant drop from 61 days the prior year. This data point confirms that liquidity has become highly selective. The market effectively punished assets relying solely on narrative while rewarding those facilitating real economic throughput.

BNB's positive performance against a 9.7% industry drawdown serves as a lagging indicator of this structural change. Value is accruing to the "hardware" of the crypto economy—settlement, liquidity, and compliance—rather than the "software" of speculation. As the industry matures, assets that function as essential utilities for trading, payment settlement, and institutional collateral are decoupling from the broader volatility of the asset class.

에서 찾아주세요:

X (Twitter) | Telegram | Reddit

지금 CoinCarp 앱을 다운로드하세요: https://www.coincarp.com/app/