Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

2.3 Billion Muslims, One Crypto – Why MECCACOIN Leads the Halal Crypto Revolution

2.3 Billion Muslims, One Crypto – Why MECCACOIN Leads the Halal Crypto Revolution Sponsored

2.3 Billion Muslims, One Crypto – Why MECCACOIN Leads the Halal Crypto Revolution Sponsored The Islamic finance revolution has found its digital champion: MECCACOIN, the world's first cryptocurrency fully certified halal by Al-Azhar scholars, is reshaping how 2.3 billion Muslims engage with the global digital economy. As conventional cryptocurrencies struggle to meet Sharia compliance standards, this Solana-powered token emerges as the definitive answer to a trillion-dollar question—how can the world's fastest-growing religious community participate in blockchain innovation without compromising their faith?

This isn't just another crypto project chasing hype. It's a phenomenon analysis of how ethical finance, technological innovation, and spiritual values are converging to create what may be the most significant shift in Islamic finance since the introduction of modern banking.

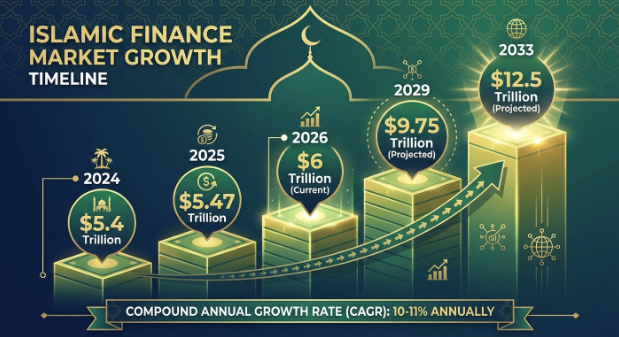

The untapped giant: Understanding the global muslim crypto opportunity

The global Muslim population represents the single largest underserved market in digital finance, with over 2 billion people seeking ethical alternatives to conventional financial systems. According to Pew Research Center data from 2025, Muslims now comprise approximately 26% of the world's population—a figure that continues to grow faster than any other religious demographic, with projections suggesting parity with Christianity by 2050.

The numbers paint a compelling picture of opportunity and urgency:

- 2.06+ billion Muslims globally as of 2026, representing one-quarter of humanity

- $5.4 trillion in global Islamic finance assets, projected to reach $9.75 trillion by 2029

- 60% of the world's 1.4 billion unbanked adults live in Muslim-majority countries

- 13% of unbanked Muslims explicitly cite religious reasons for avoiding conventional banks

This isn't merely a demographic observation—it's a call to action. The Organisation of Islamic Cooperation (OIC) member countries show account ownership rates of just 41% compared to 92% in high-income nations. Millions of Muslims actively choose financial exclusion over compromising their beliefs. The halal revolution in cryptocurrency isn't about converting skeptics; it's about welcoming home a community that has been waiting for the right invitation.

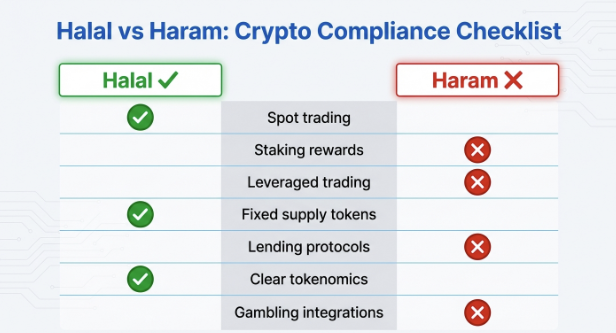

Why traditional crypto falls short for muslim investors

Most cryptocurrencies fail Sharia compliance testing due to structural elements that conflict with fundamental Islamic finance principles. The challenges aren't minor technical details—they strike at the heart of what makes financial activity permissible under Islamic law.

The Three Pillars of Islamic Finance Compliance

Islamic jurisprudence (Fiqh al-Mu'amalat) establishes clear boundaries for permissible financial activity:

| Prohibited Element | Arabic Term | Why It Matters | Common Crypto Violations |

|---|---|---|---|

| Interest/Usury | Riba | Money must not generate money passively | Staking rewards, lending protocols, yield farming |

| Excessive Uncertainty | Gharar | Contracts must be clear and transparent | Unclear tokenomics, speculative derivatives, futures trading |

| Gambling | Maysir | Wealth must come from legitimate effort | Meme coin speculation, pump-and-dump schemes, leveraged trading |

| Prohibited Industries | Haram | Funds cannot support forbidden activities | DeFi protocols linked to gambling, alcohol, or adult content |

Traditional cryptocurrencies like Bitcoin have received mixed scholarly opinions—some deem them permissible when traded on spot markets without leverage, while others raise concerns about speculative use. Ethereum's transition to Proof-of-Stake has created additional debate, as staking rewards could potentially resemble interest-bearing mechanisms.

The ambiguity leaves Muslim investors in a difficult position: participate and risk violating religious principles, or abstain and miss the wealth-building opportunities of the digital age. Neither option serves the Ummah well.

MECCACOIN: Engineering compliance from the ground up

MECCACOIN eliminates the guesswork by building Sharia compliance into its foundational architecture, not as an afterthought. Certified halal by a distinguished Islamic Sharia Committee comprising scholars from Al-Azhar Al-Sharif—one of Islam's most respected institutions of learning—every aspect of this cryptocurrency has been designed to honor both innovation and tradition.

Core compliance architecture

The token operates on the Solana blockchain, chosen specifically for its high-speed, low-cost transactions that enable practical everyday use without the fee burdens that plague other networks. But technology selection was just the beginning.

What Makes MECCACOIN Different:

- No Staking Mechanisms: Unlike many modern cryptocurrencies, MECCACOIN does not offer staking rewards. This eliminates any possible comparison to interest-bearing instruments, ensuring complete riba compliance.

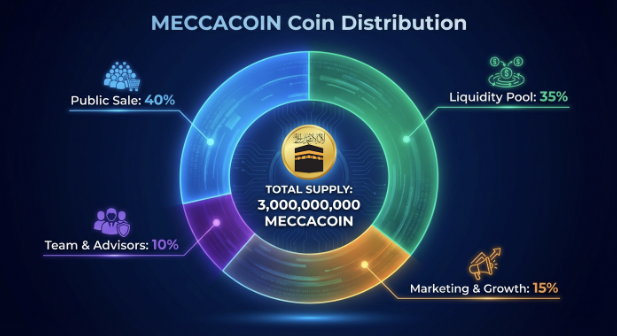

- Fixed Supply Economics: With exactly 3 billion tokens in total supply and no minting capability, the tokenomics are transparent and free from inflationary manipulation. What you see is what exists—forever.

- No Lockup Requirements: Users maintain complete control over their funds at all times. There are no forced holding periods or penalty structures that create contractual ambiguity.

- Continuous Sharia Oversight: All transactions, smart contracts, and governance decisions undergo review by the Islamic Sharia Committee, ensuring ongoing compliance rather than one-time certification.

- Prohibited Industry Exclusion: The ecosystem actively monitors and prevents integration with gambling platforms, alcohol-related businesses, or any haram activities.

The scholars behind the certification

Credibility in Islamic finance comes from recognized scholarly authority. MECCACOIN's Sharia Committee includes:

Sheikh Dr. Tariq Nasr – Chief Researcher at Al-Azhar Al-Sharif, specializing in Islamic economic systems and digital asset jurisprudence.

Prof. Dr. Hamdi Sobhi Taha – Member of the Council of Senior Scholars at Al-Azhar Al-Sharif, with extensive expertise in Fiqh al-Mu'amalat and modern Islamic finance applications.

Prof. Dr. Jalal Al-Din Ismail Hassan – Member of the Council of Senior Scholars at Al-Azhar Al-Sharif, renowned for Sharia governance in financial institutions.

This isn't certification theater. These scholars actively oversee operations, audit smart contracts, and ensure every evolution of the platform maintains the highest standards of Islamic jurisprudence.

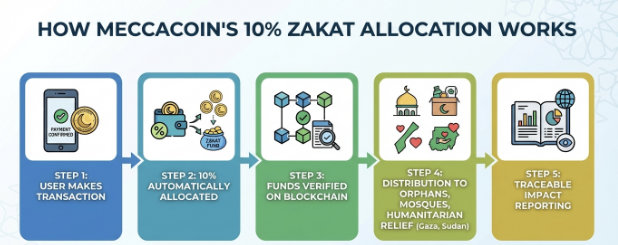

The zakat revolution: Charity built into every transaction

MECCACOIN transforms routine financial activity into continuous spiritual reward by allocating 10% of every transaction to zakat and sadaqah. This isn't a marketing promise—it's a core protocol feature with blockchain-verified transparency.

The charitable allocation system addresses multiple Islamic obligations simultaneously:

For Zakat (Obligatory Giving): Muslims are required to give 2.5% of their wealth annually to those in need. MECCACOIN's automatic allocation ensures that charitable giving becomes seamlessly integrated into financial activity, never forgotten or delayed.

For Sadaqah (Voluntary Charity): Beyond obligatory requirements, Islam encourages continuous charitable giving. Every MECCACOIN transaction becomes an opportunity for spiritual reward, transforming commerce into worship.

For Humanitarian Impact: Funds flow to verified causes supporting orphans, mosques, and humanitarian relief in Islamic communities worldwide, including crisis regions like Gaza and Sudan. Blockchain transparency ensures donors can trace their contributions from wallet to impact.

This mechanism represents something unprecedented in cryptocurrency: a digital asset that generates continuous barakah (blessing) through normal use. The implications extend beyond individual users to potentially revolutionizing how the global Muslim community approaches charitable giving in the digital age.

Security infrastructure: Trust built on verification

The cryptocurrency space has unfortunately seen numerous projects that promise compliance but deliver deception. MECCACOIN addresses this concern through comprehensive third-party verification from globally recognized security firms.

Completed Security Audits:

- Coinsult (Netherlands): Full smart contract audit confirming 100% security compliance

- CertiK: Audit by the world's leading blockchain security company, verifying highest security standards

- SolidProof (Germany): Complete team KYC verification, ensuring accountability and transparency

These aren't superficial reviews. Each audit examines smart contract code for vulnerabilities, tests transaction handling for exploits, and verifies that the technical implementation matches documented claims. For Muslim investors who understand that trust (amanah) is a sacred responsibility, this verification infrastructure provides the assurance needed for confident participation.

The ecosystem vision: Beyond currency to community

MECCACOIN's roadmap extends far beyond simple payment functionality into a comprehensive Islamic digital economy. The five-phase development plan demonstrates long-term commitment to serving the Ummah.

Phase 1-2: Foundation and launch (completed)

Research on Islamic finance and blockchain integration, Sharia Committee formation, smart contract development on Solana with security audits, and successful token deployment.

Phase 3: Platform development (current)

Development of the MECCACOIN Wallet for secure halal storage, integration of zakat and sadaqah donation features, and establishment of transparent charitable fund allocation.

Phase 4: Ecosystem expansion

Sharia-compliant savings options, cross-border remittance services with minimal fees, business and e-commerce integration for halal transactions, and smart contract tools for Islamic finance.

Phase 5: Global adoption

Expansion into Islamic-majority regions across the Middle East, North Africa, and Southeast Asia. Partnerships with Islamic banks and fintech providers. Regulatory approvals for mainstream adoption.

Future innovations include:

- Mecca City in the Metaverse – virtual spaces for prayer, community gathering, and Islamic education

- Sharia-Certified Mastercard – enabling halal spending anywhere cards are accepted

- Islamic NFT Collectibles – digital art and assets that respect Islamic artistic traditions

- Halal DeFi Tools – decentralized finance mechanisms redesigned for Sharia compliance

- Islamic Microfinance – empowering small business owners in underserved communities

The global muslim crypto phenomenon: Why now?

Several converging forces make 2025-2026 the pivotal moment for halal cryptocurrency adoption.

Demographic momentum

The Muslim population's median age is just 24, compared to 33 for non-Muslims globally. This younger demographic has grown up digital-native, comfortable with technology, and eager for solutions that respect their values. They don't see faith and innovation as conflicting—they expect integration.

Islamic finance maturation

The Islamic finance industry has spent decades developing sophisticated Sharia-compliant instruments. Sukuk (Islamic bonds) alone reached $193 billion in 2022. Green sukuk issuance exceeded $22 billion in 2023. This institutional foundation creates the scholarly and regulatory framework for cryptocurrency integration.

Financial inclusion imperative

With account ownership in OIC countries at just 41%, hundreds of millions of Muslims remain excluded from formal financial systems. Cryptocurrency offers a path to participation that bypasses traditional banking infrastructure—but only if it respects the religious principles that caused exclusion in the first place.

Technology readiness

Solana's network can process 65,000 transactions per second at fractions of a cent per transaction. This performance level makes cryptocurrency practical for everyday purchases—buying groceries, paying bills, sending remittances—rather than just speculative trading.

Investment considerations: Balancing faith and finance

MECCACOIN represents more than an investment opportunity—it's participation in a movement toward ethical digital finance. For Muslim investors evaluating participation, several factors merit consideration.

Alignment with Values: Unlike conventional cryptocurrencies that require compromise or scholarly debate, MECCACOIN offers clear halal certification from recognized authorities. This removes the spiritual uncertainty that has kept many Muslims on the sidelines.

Utility Beyond Speculation: The ecosystem design emphasizes real-world use cases—payments, remittances, charitable giving, business transactions—rather than pure price speculation. This utility-focused approach aligns with Islamic principles that discourage gambling and encourage productive economic activity.

Community Building: Investment in MECCACOIN supports infrastructure that serves the broader Muslim community. From charitable allocations to Islamic finance innovation, participation contributes to collective benefit.

Risk Awareness: Like all cryptocurrency investments, MECCACOIN carries market volatility risks. Islamic finance principles encourage risk-sharing rather than risk avoidance, but investors should participate only with funds they can afford to lose and should avoid leverage or speculative trading strategies.

How to participate in the Halal crypto revolution

For those ready to join the movement, MECCACOIN offers multiple entry points designed for accessibility.

Cryptocurrency Purchases: Connect wallets like MetaMask (for ETH/BNB/USDT), Phantom (for SOL), or Unisat (for BTC) to participate through familiar crypto channels.

Fiat Purchases: Use Visa, Mastercard, or PayPal directly—no existing crypto or technical knowledge required. This accessibility ensures that the halal revolution isn't limited to those already comfortable with blockchain technology.

Network Options: Choose from Ethereum, BSC, Solana, or Bitcoin networks based on your preferences for speed, cost, and existing holdings.

The presale phase offers early participants favorable pricing before exchange listings, with coins claimable after presale completion. Initial DEX listings will include Uniswap (Ethereum), PancakeSwap (BSC), and Raydium (Solana).

The future belongs to ethical finance

MECCACOIN stands at the intersection of two powerful global movements: the digital transformation of finance and the ethical investment revolution. For 2.3 billion Muslims seeking to participate in the blockchain economy without compromising their faith, it offers something unprecedented—a path forward that honors both innovation and tradition.

The halal revolution isn't coming. It's here. And it's being built one transparent, certified, charitable transaction at a time.

For the Muslim investor who has watched the crypto revolution from the sidelines, uncertain whether participation could ever align with deeply held beliefs, MECCACOIN represents an answer years in the making. For the skeptic who doubted whether blockchain technology could serve spiritual as well as financial purposes, the automatic zakat mechanism demonstrates that the two are not only compatible but complementary.

The global Muslim community has waited long enough for financial solutions that respect their values. The technology is ready. The scholarly certification is complete. The ecosystem is building.

The question is no longer whether halal cryptocurrency is possible. The question is whether you'll be part of the community that makes it mainstream.

Visit meccacoin.meme to learn more about the halal crypto revolution and join the movement toward ethical digital finance.

Disclaimer: Cryptocurrency investments carry significant risk. This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult qualified advisors before making investment decisions.

Bitcoin Production Cost Drops to $77K: JPMorgan’s Surprising Bullish Signal for Crypto Markets

Bitcoin Production Cost Drops to $77K: JPMorgan’s Surprising Bullish Signal for Crypto Markets

CFTC Brings Crypto Heavyweights Onto Advisory Panel Amid Fight Over Market Structure

CFTC Brings Crypto Heavyweights Onto Advisory Panel Amid Fight Over Market Structure

Pocket Network Deflation: Revolutionary Programmable Economics Transforms Web3 Infrastructure

Pocket Network Deflation: Revolutionary Programmable Economics Transforms Web3 Infrastructure

London Stock Exchange Group Unveils Revolutionary On-Chain Settlement System for Institutional Investors

London Stock Exchange Group Unveils Revolutionary On-Chain Settlement System for Institutional Investors