Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

How to Identify Crypto Scams?

There is no doubt that blockchain technology has shaped the future world, especially Defi(Decentralized Finance), which is the great revolution for finance. However, because of the decentralized attribute of blockchain, it also became a crime haven for scammers. It is a world riddled with elaborate scams to swindle investors' money. In general, the scams can be classified as Honeypots and Rug pulls(Learn: What's A Rug Pull in Crypto?). In the article, we will mainly try to focus on crypto scams and show you how to find out a token scam.

What Is a Honeypot Crypto?

The term honeypot is a computer security term, it means baiting a trap for hackers. As a crypto honeypot, it is similar. Honeypot crypto is a cryptocurrency in which the honeypot creator (attacker) inserts a piece of code into the smart contract and makes it only the honeypot creator (attacker) can sell or withdraw the crypto. With the feature of concealment, it is less obvious and more difficult to detect, even for experienced crypto investors. People easily fall victim to honeypots for the honeypot crypto price rapidly pumping and believe it will to the moon soon.

How Does Scam Crypto Work?

In the past, hackers will exploit smart contracts and rob the digital assets away. However, nowadays, many attackers do not search for vulnerable contracts but try to deploy vulnerable contracts that contain hidden traps to lure investors. That's what we called crypto honeypots. It is commonly happening on Ethereum and BSC. A honeypot crypto scam always operates in 3 steps:

- The attacker deploys a smart contract with traps and places bait that promise high profits;

- The attacker tries their best to attract you to buy the token. The victim starts buying and can commonly see the price increasing rapidly. Victims will likely stay for a while until they think it's enough and try to cash out. However, the victims find it is impossible to sell the tokens at this moment.

- The attacker withdraws the funds that the victims invest.

Nowadays, the scammers evolve and create more elaborate schemes, for example:

- The honeypot creator (attacker) can turn on or turn off the selling function of the token. The moment you are buying it is available to sell, while the price goes high, you are unable to sell.

- Scammers create a wallet and deposit a certain amount of Ethereum-based tokens and leak the private key to the public and people rush to withdraw coins. Before approving the transaction, users needed to spend some gas fees. In order to get the coins, people will deposit some ETH into the wallet. Here is the tricky part: the intelligent contract took the gas fee and moved it to a secondary wallet. In the end, the transaction would fail because the system would find no funds for the gas fee. No one can get the original tokens but lost their ETH.

- Variable taxes on Smart Contracts. It means allowing the contract creators to change the buy, sell, or even transfer tax of a token. Creators can set buying or selling tax for a token, if they set a high selling tax, then it is almost impossible to sell or you will be charging a high tax.

How to Identify and Spot Scam Tokens and Avoid Buying Them?

There are several ways to identify scam tokens, though it is not 100% accurate.

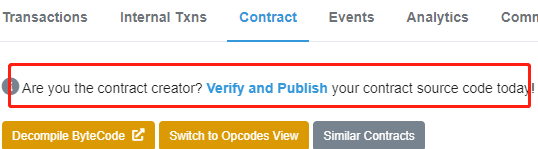

- If the token is an ERC-20 token, you can check the code on Etherscan. You can find out whether the code is verified or not. If the code is not verified, maybe it is a scam token. Scammers will not reveal the codes because the codes always come with problems and bugs. The procedures are as follows: input the token contract address and click "Contract", if it says "Are you the contract creator? Verify and Publish your contract source code today!", then it means not verify! Similar to BSC-20 tokens, you can check on BscScan.

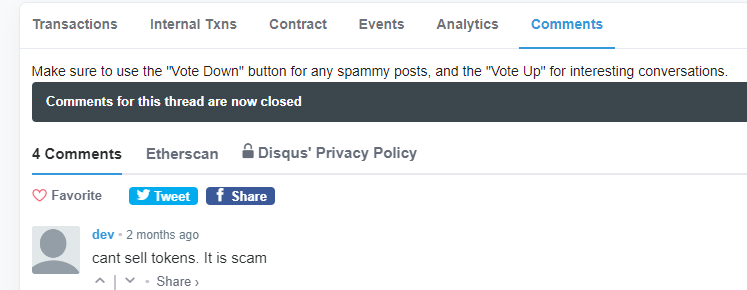

- Check the comments on Etherscan or BscScan. Victims may leave comments on the scam token comments tab. You can find out people's views about the token. However, the comments are not 100% correct, some of the comments contain advertising or misleading information, you should make a judgment by yourself.

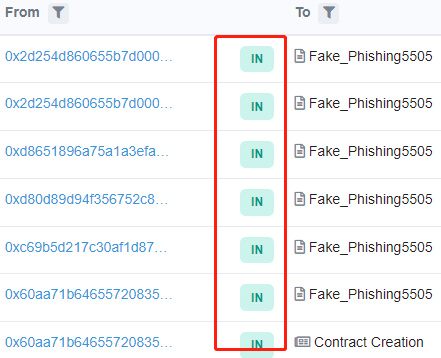

- Check the token transactions data on blockchain explore, such as Etherscan, BscScan, or other blockchain explorers (depends on what blockchain the token is on). Enter the Token contract address, then examine the transaction list. If there are no wallets selling or only one or two wallets doing all the selling. It's most likely a honeypot scam crypto. If many wallets are selling, it may not a scam crypto.

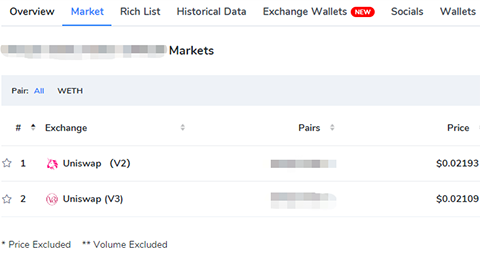

- Check on CoinCarp.com, and find out the number of centralized exchanges(CEX) that have listed the token. If the token is only listed on decentralized exchanges (DEX), then you should be cautious about the investment. A good reputation token will be listed on CEX, however, it is also not absolute, some early projects may just be listed on DEX.

- Check the amount of liquidity in a token's pool on decentralized exchanges such as Uniswap, Pancake, or other decentralized exchanges. Liquidity means the number of tokens locked in smart contracts to enable people to buy and sell in decentralized exchanges. If liquidity is low(less than $50,000) and drops rapidly, then maybe it is a scam token or an abandoned project.

- Check the holders of the token, if one or a few wallets hold most of the tokens, then you should be careful. Do some research about the allocation of the token, and find out the percentage of tokens that allocate to the team, you should be careful if the team with high percentage allocation. What's more, if a token is supposed to have a maximum supply but it has a "mint function" then you should do more research on it! Because it is possible that the creator will mint himself a bunch of tokens and then sell them, and run off with all the money.

- Do your own research(DYOR) about the project. You can visit their official website, and check the register time of the domain name on whois, if it was registered within 24 hours or less of the project launch, you should be careful. Also, you should do some research on their social media, the follower on Twitter and Telegram. Their followers are always fake and with the features of random crap in their usernames and fake avatars.

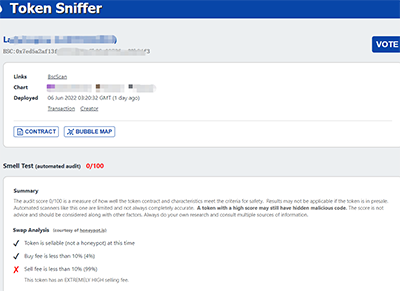

- Use the third-party analysis tools to identify the scam token, such as Honeypot Detector or Token Sniffer, these are easy tools that be used to search for various tokens on both Ethereum and Binance Chain. Simply copy and paste the token contract address into the search bar, and the tools will provide info on exploits, a brief contract audit, and more. Token Sniffer also provides a list of known scams and hacks, which is a great place to see if a suspected token is listed. Note: These tools can not provide 100% accuracy.

Closing Thought

Cryptocurrency, Defi, and NFT are the new things developed by blockchain technology in recent years. Some people take the view that the crypto world is like a wild west and full of opportunities to get rich over a night, meanwhile, it is a world with scammers and potential threats just like the real world. These tips sort out by CoinCarp can help you identify crypto scams, if you have more questions, please join the CoinCarp community on Telegram and discuss with us.

$30,000 Deposit Blast-Off

Sponsored

Earn up to $30,000 when you make your first deposit and trade on Bybit! Register Now!

- Appchains: The Next Evolution in Blockchain TechnologyBeginner 2m

- PFP (Profile Picture) NFTs: Unlocking Digital Identity and CreativityBeginner 2m

- Soft Money vs. Hard Money: Decoding Currency Types and Their ImpactBeginner 2m

- Bitcoin Stamps: A Secure and Immutable Addition to the Crypto LandscapeIntermediate 2m