Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

What Are ERC-20 Tokens?

ERC-20 Standard

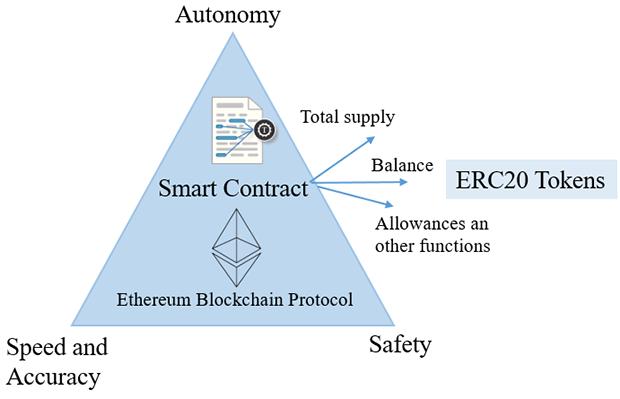

As far as Ethereum is concerned, ERC stands for Ethereum Request for Comments, which is a technical document outlining Ethereum programming standards. Unlike Ethereum Improvement Proposals (EPIS) that suggest improvements to the protocol itself, the goal of ERCS is to establish agreements that make it easier for Dapps and smart contracts to interact with each other.

Proposed by Vitalik Buterin and Fabian Vogelsteller in 2015, ERC-20 refers to a relatively simple format for Etherium-based tokens. By following the outline, developers can build a foundation that has been used throughout the industry. Basically, it is a standard interface (protocol) for tokens based on Ethereum. Once new ERC-20 tokens are created, they can automatically interoperate with services and software that support the ERC-20 standard, such as software wallets, hardware wallets, and exchanges.

It is worth noting that the ERC-20 standard has gradually developed into EIP (specifically, EIP-20).

ERC-20 Tokens

The ERC-20 standard sets out the rules governing Etherium-based tokens (including name, symbol, divisibility) and describes the core functionality of all the tokens. As a result, these digital assets are often referred to as ERC-20 tokens, which represent a large portion of existing cryptocurrencies. Basically, ERC-20 tokens are a subset of Ethereum tokens, all of which through the ERC-20 standard, and enable interactions between smart contracts and Dapps on the Ethereum blockchain.

For instance, stablecoins are often issued using the ERC-20 standard. For a typical fiat-backed stablecoin, the issuer holds reserves such as euros and dollars. For every unit in the reserve, they will issue a token, which means that if 100 dollars are locked in a vault, the issuer can create 100 tokens and each token can be exchanged for 1 dollar. Technically, due to the use of the ERC-20 standard, the issuance of stablecoins is easy to implement on the Ethereum platform. The issuer only needs to issue a contract containing 100 tokens. Then, they will distribute these tokens to users and promise that they can exchange them for a certain percentage of legal tender in the future. Subsequently, thanks to the ERC-20 standard, users can use tokens to directly purchase goods and services on the Ethereum network. And this token is also known as one of the ERC-20 tokens.

Pros and Cons of ERC-20 Tokens

1. Pros of ERC-20 Tokens

- Fungible — ERC-20 tokens are fungible and each unit is interchangeable with another. They would still be functionally identical, just like cash or gold, which is ideal if your token aims to be a currency.

- Flexible — ERC-20 tokens are highly customizable and can be tailored to many different applications. For instance, they can be used as in-game currency, in loyalty points programs, as digital collectibles, or even to represent fine art and property rights.

- Popular — The popularity of ERC-20 in the cryptocurrency industry is a very convincing reason to focus on future development. There are currently a large number of exchanges, wallets, and smart contracts that are compatible with the newly launched tokens.

2. Cons of ERC-20 Tokens

- Scalability — Trying to send transactions during peak hours results in high fees and delays. If the issuer launches an ERC-20 token and causes network congestion, the token's availability may be affected. This is not a problem unique to Ethereum. On the contrary, in a secure distributed system, this is a necessary trade-off.

- Scams — Since creating a simple ERC-20 token requires very little effort, which means that anyone can issue tokens on the Ethereum network. Therefore, investors should be cautious in choosing investment objects and beware of some Pyramids and Ponzi schemes disguising themselves as blockchain projects.

$30,000 Deposit Blast-Off

Sponsored

Earn up to $30,000 when you make your first deposit and trade on Bybit! Register Now!

- Appchains: The Next Evolution in Blockchain TechnologyBeginner 2m

- PFP (Profile Picture) NFTs: Unlocking Digital Identity and CreativityBeginner 2m

- Soft Money vs. Hard Money: Decoding Currency Types and Their ImpactBeginner 2m

- Bitcoin Stamps: A Secure and Immutable Addition to the Crypto LandscapeIntermediate 2m