Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

What Is DeFi?

Introduction

Defi stands for Decentralized Finance, a financial application ecosystem built on a blockchain network. In other words, DeFi establishes an open-source and transparent financial system that provides financial services to everyone without central authorities. It creates entirely new financial markets, products, and services.

More specifically, the traditional financial system is controlled by central authorities such as the government and banks. They control the flow of funds and provide most of the financial services. For example, money transfers, savings plans, insurance and the stock markets. The traditional financial system was built on the trust of investors. However, the centralized financial system (or CeFi for short) has its own risks, such as mismanagement, fraud and corruption. It has the potential to collapse from the center and it is quite expensive. The alternative is decentralized finance that does not have a central authority. They are open and trustworthy to anyone since they are literally a series of running program codes. Moreover, they are censorship-resistant and much cheaper than traditional central finance.

DeFi is developed mainly based on cryptography, blockchain technology and smart contracts. The following are the five pillars of DeFi:

1. Stablecoin

Stablecoin is a bridge between DeFi and CeFi, and it's a cryptocurrency that matches real-world assets. For example, the value of the USDC is pegged to the US dollar, and a USDC stablecoin is worth one US dollar. The purpose of developing stablecoins is to provide a convenient and reliable way to convert different cryptocurrencies into real value, thereby making transactions easier. To better understand the role of stablecoin, let's give an example to illustrate.

If you bought an Ethereum for $500, and now it is $1,000, you want to sell it for a profit. Without a stablecoin, you have to sell your Ethereum on a centralized exchange like Coinbase or Binance, and the exchange will take a cut from it. The next step is to wait for the exchange to transfer the amount to your bank account. After this, If Ethereum drops to $250 and you want to buy it, you need to put $1000 back into a centralized exchange, wait a few days for the transaction to clear, then buy 4 Ethereum units and hold them. In this process, fees and long waits must be paid in order to complete the transaction.

In contrast, if we use a stablecoin like USDC, when Ethereum goes up to $1,000, you convert it into $1,000 worth of USDC, and if Ethereum goes down to $250 after that, then buy back four Ethereum with that $1,000 USDC. Since a decentralized exchange can be used for trading, the transaction fee is extremely low and the transaction can be completed almost immediately. Decentralized exchanges and stablecoins can replace the functions of banks and make the whole transaction process easier and more convenient.

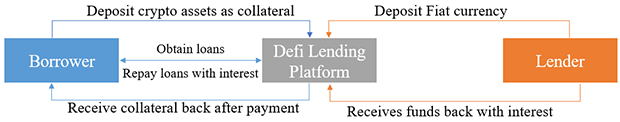

2. Borrowing and Lending

In fact, the current financial system is largely based on borrowing and lending. When we borrow money from a bank, we usually need to pay a 20% down payment as collateral. If we cannot repay the loan, we have to bear the legal responsibility. In the case of cryptocurrencies, due to their anonymity, it is completely possible to pay a 20% down payment and never show up, and never pay back the rest of the loan. However, this problem can be solved through the use of smart contracts. While a usual contract uses legal terminology to specify the terms of the relationship between the entities entering the contract, a smart contract uses computer code. Since their terms are written in computer code, smart contracts have the unique ability also to enforce those terms through computer code. This enables the reliable execution and automation of a large number of business processes that currently require manual supervision.

For instance, person A wants to earn interest on his cryptocurrencies, and B wants to borrow some cryptocurrencies. Then, A deposits his cryptocurrencies into a smart contract and gets one token representing his original currency plus interests. And if B wants to borrow $100, he has to deposit $120 into the smart contract as collateral. In this way, even if B does not repay the loan in the future, the smart contract will automatically transfer the principal plus interest to A's account. These are done automatically through code, which is secure and reliable.

3. Decentralized Exchanges

Decentralized exchanges are written in code and are not controlled by governments or banks. The most popular decentralized exchanges work in which investors pool their money and traders make trades. Decentralized exchanges have opened the world to a whole new model of how finance works. Unlike decentralized exchanges, centralized exchanges typically only allow users to trade small amounts of cryptocurrencies because they are regulated by governments and must follow certain rules. By contrast, one of the most popular decentralized exchanges, Uni Swap, offers hundreds or even thousands of cryptocurrencies and tokens that investors can trade freely without being supervised by any party. Billions of dollars are locked in these liquidity pools, but no one can control these funds. They just follow a program, a series of codes, and are immutable.

4. Insurance

With decentralized finance, the code can function as an insurance company. For example, if a farmer wants to buy crop insurance to protect his income and increase his risk tolerance. A technician can write a piece of code on the Ethereum network that says if the temperature goes over 90 degrees for four days in a row this summer, will pay the farmer $100,000. However, in order for the contract to take effect, the farmer must first pay $2,000. The farmer can buy crop insurance through this smart contract, which is a code that determines whether the payment conditions are met. And in order to connect the real world to the blockchain, you can use Oracle as a source of information, a bridge between the real world and the crypto world. In this example, an oracle can be created in the city to read the temperature and be verified by some people to ensure that it will not be deceived. Then the smart contract can reliably use it as a data source to determine whether to meet insurance requirements.

5. Margin Trading

Margin trading refers to the use of funds provided by a third party for asset transactions. Compared with regular trading, margin accounts allow traders to obtain larger amounts of funds, enabling them to utilize their positions. In essence, margin trading amplifies the results of the transaction, so that traders can achieve greater profits. In traditional markets, the borrowed funds are usually provided by investment brokers. However, in cryptocurrency trading, funds are usually provided by other traders who earn interest based on market demand for margin funds. In traditional centralized finance, for margin trading, you usually need to be able to prove your identity, income, and pay expensive fees. In contrast, conducting margin trading through decentralized finance can be much faster, open to anyone, and much safer.

Main Advantages of DeFi

- Traditional finance relies on institutions such as banks to act as intermediaries and courts to provide arbitration. In contrast, DeFi does not require any intermediaries or arbitrators. Its code specifies the resolution of every possible dispute, and users always maintain control over their funds. This greatly reduces the associated costs and allows for a more frictionless financial system.

- Since DeFi data is recorded on the blockchain and distributed on thousands of nodes, it makes censorship or service shutdown a complex and nearly impossible task.

- For those individuals who could not have access to financial services, they can easily obtain these services through the open platform of DeFi. Since traditional financial systems rely on profit-making intermediaries, their services are usually not provided in low-income communities. However, with DeFi, low-income earners can also benefit from a wider range of financial services.

$30,000 Deposit Blast-Off

Sponsored

Earn up to $30,000 when you make your first deposit and trade on Bybit! Register Now!

- Appchains: The Next Evolution in Blockchain TechnologyBeginner 2m

- PFP (Profile Picture) NFTs: Unlocking Digital Identity and CreativityBeginner 2m

- Soft Money vs. Hard Money: Decoding Currency Types and Their ImpactBeginner 2m

- Bitcoin Stamps: A Secure and Immutable Addition to the Crypto LandscapeIntermediate 2m