Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

What Is An Order Book in Crypto and How to Use It for Trading?

If you are interested in trading cryptocurrencies, you might have come across the term "order book" and wondered what it means. An order book is an electronic document that records the buy and sell orders of a specific cryptocurrency pair on a trading platform, such as a centralized or decentralized exchange. It provides traders with valuable information about the market demand, supply, price levels, and trading volume of a cryptocurrency. In this article, we will explain what an order book is, how it works, and how you can use it to improve your trading decisions.

What Is An Order Book?

An order book is a list of orders that traders place to buy or sell a certain amount of a cryptocurrency at a certain price. Each order has a price and a quantity, and is either a bid (buy order) or an ask (sell order). Bids and asks are also known as the market depth, as they show how deep the market is at different price levels.

An order book is usually displayed in a table format, with three columns: price, amount, and total. The price column shows the valuation of the orders, the amount column shows the quantity of the orders, and the total column shows the cumulative quantity of the orders from the highest bid or lowest ask to the current price level. The table is divided into two sections: the buy side and the sell side. The buy side displays the bids, usually in green, while the sell side displays the asks, usually in red.

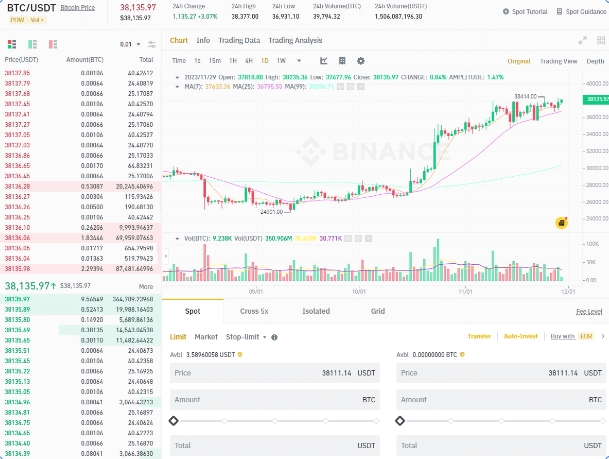

Here is an example of an order book for the BTC/USD pair on Binance:

The order book shows the current market price of BTC/USD, which is $38,135.97, as the midpoint between the highest bid ($38,137.85) and the lowest ask ($38,134.39). The order book also shows the spread, which is the difference between the highest bid and the lowest ask. The spread is an indicator of the liquidity and volatility of the market. A narrow spread means that the market is liquid and stable, while a wide spread means that the market is illiquid and volatile.

The order book also shows the order size, which is the quantity of the orders at each price level. The order size reflects the market interest and activity of the traders. A large order size means that there is a high demand or supply at that price level, while a small order size means that there is a low demand or supply. The order size can also affect the price movement of the market, as a large order can create a significant impact on the market price when executed.

How Does An Order Book Work?

An order book works by matching the bids and asks of the traders according to the price and time priority. The price priority means that the orders with the best price (highest bid or lowest ask) are executed first, while the time priority means that the orders with the same price are executed according to the time they were placed, with the oldest orders executed first.

When a trader places a bid or an ask, the order is either executed immediately or added to the order book, depending on the type of the order and the market conditions. There are two main types of orders: market orders and limit orders.

- A market order is an order that is executed immediately at the best available price in the market. A market order does not specify a price, but only a quantity. A market order is guaranteed to be executed, but not at a fixed price. A market order can be either a market buy order or a market sell order.

- A market buy order is an order to buy a certain amount of a cryptocurrency at the lowest ask price in the market. A market buy order can be executed partially or fully, depending on the availability of the asks in the order book. A market buy order can also move the market price up, as it consumes the lowest asks and raises the lowest ask price.

- A market sell order is an order to sell a certain amount of a cryptocurrency at the highest bid price in the market. A market sell order can be executed partially or fully, depending on the availability of the bids in the order book. A market sell order can also move the market price down, as it consumes the highest bids and lowers the highest bid price.

- A limit order is an order that is executed only at a specified price or better. A limit order specifies both a price and a quantity. A limit order is not guaranteed to be executed, but it can be executed at a fixed or better price. A limit order can be either a limit buy order or a limit sell order.

- A limit buy order is an order to buy a certain amount of a cryptocurrency at a specified price or lower. A limit buy order can be executed partially or fully, depending on the availability of the asks in the order book. A limit buy order can also create a support level for the market price, as it increases the demand at that price level.

- A limit sell order is an order to sell a certain amount of a cryptocurrency at a specified price or higher. A limit sell order can be executed partially or fully, depending on the availability of the bids in the order book. A limit sell order can also create a resistance level for the market price, as it increases the supply at that price level.

When a limit order is placed, it is either executed immediately or added to the order book, depending on the market conditions. If the limit order matches or crosses the opposite side of the order book, it is executed immediately at the best available price. For example, if a trader places a limit buy order at $36,500, and there are asks at $36,450 or lower, the order is executed immediately at $36,450 or lower. However, if the limit order does not match or cross the opposite side of the order book, it is added to the order book and waits to be executed. For example, if a trader places a limit buy order at $36,400, and there are no asks at $36,400 or lower, the order is added to the buy side of the order book and waits for an ask to reach that price level.

How to Use an Order Book for Trading?

An order book can be a useful tool for traders to analyze the market conditions and make informed trading decisions. By using an order book, traders can:

- Identify the market trend and sentiment. An order book can show the direction and strength of the market trend, as well as the market sentiment of the traders. A rising market price, a narrow spread, and a large buy volume indicate a bullish trend and sentiment, while a falling market price, a wide spread, and a large sell volume indicate a bearish trend and sentiment.

- Find the best entry and exit points. An order book can show the favorable price levels to enter and exit a trade, as well as the potential risks and rewards. A trader can use the order book to find the support and resistance levels, which are the price levels where the market price tends to bounce or break. A trader can also use the order book to find the liquidity and volatility levels, which are the price levels where the market price tends to move fast or slow. A trader can use these levels to set the optimal order type, price, and quantity for a trade.

- Avoid slippage and market impact. An order book can show the possible slippage and market impact of a trade, which are the differences between the expected and actual execution price and quantity of a trade. A trader can use the order book to estimate the slippage and market impact of a trade, and adjust the order type, price, and quantity accordingly. A trader can also use the order book to avoid placing large market orders, which can cause significant slippage and market impact, and opt for smaller or limit orders instead.

What Is A Depth Chart in Crypto?

A depth chart is a tool that shows the supply and demand of a cryptocurrency at different prices. It is a graphical representation of an order book, which is a list of buy and sell orders of a cryptocurrency on a trading platform. A depth chart can help traders to understand the market conditions and make informed trading decisions.

A depth chart usually consists of two lines: a green line for the buy orders (bids) and a red line for the sell orders (asks). The horizontal axis shows the different prices at which the orders are placed, and the vertical axis shows the cumulative amount of the orders at each price level. The point where the two lines meet is the current market price of the cryptocurrency.

A depth chart can show the market trend and sentiment, the liquidity and volatility, and the support and resistance levels of the cryptocurrency. A rising market price, a narrow gap between the two lines (spread), and a large buy volume indicate a bullish trend and sentiment, while a falling market price, a wide spread, and a large sell volume indicate a bearish trend and sentiment. A large order size at a certain price level indicates a high demand or supply, which can create a support or resistance level for the market price. A small order size at a certain price level indicates a low demand or supply, which can create a liquidity or volatility level for the market price.

Conclusion

An order book is an essential component of any cryptocurrency trading platform, as it records the buy and sell orders of a specific cryptocurrency pair. An order book can provide traders with valuable information about the market demand, supply, price levels, and trading volume of a cryptocurrency. An order book can also help traders to identify the market trend and sentiment, find the best entry and exit points, and avoid slippage and market impact. By using an order book, traders can improve their trading performance and profitability.

Stay tuned to CoinCarp Social Media and Discuss with Us:

$30,000 Deposit Blast-Off

Sponsored

Earn up to $30,000 when you make your first deposit and trade on Bybit! Register Now!