Fiat currencies

Crypto Currencies

No results for ""

We couldn't find anything matching your search.Try again with a different term.

What Is an Automated Market Maker (AMM)?

An automated market maker(AMM) is a critical part of the decentralized exchange(DEX), it is also one of the most important instruments in decentralized finance. Unlike traditional centralized exchanges, some decentralized exchanges utilize AMM protocol(pricing algorithm)to price assets, instead of using an order book. Automated market makers have realized the possibility of trading without an order book system or traditional interaction of buyers and sellers.

Why We Need Automated Market Maker(AMM)?

- Some of the crypto exchanges use an order book and an order matching system to facilitate crypto trades. The order book records the prices at which traders desire to buy or sell cryptos. Then, with the order matching system, sell and buy orders will be matched and settled successfully. The most recent price at which crypto was bought will automatically feature as the market price of the digital asset. However, where there are may not enough counterparties to trade with, that means the market will be illiquid. To solve this problem, some crypto exchanges cooperate with banks and other institutional investors to provide liquidity continuously, which makes sure there are always counterparties to trade with. This process is "market making", and the banks and other institutional investors are "market makers ".

- However, at the early stage of decentralized exchanges, it was difficult to find enough counterparties willing to trade. So it was hard to trade coins on decentralized exchanges. There comes the concept of the automated market maker to solve this problem, which makes it possible that the average individual could function as a market maker.

What Is an Automated Market Maker(AMM)?

- Depending on the demand and supply, an automated market maker basically allows traders to buy and sell cryptocurrencies using an algorithm that automatically measures and dictates the price of assets. So with the protocol of automated market makers(AMMs), users trade directly with a pool of assets rather than with other users. As a result, a coincidence of mutual demand while trading crypto assets will not be needed.

- For example, if a user wants to trade ETC for BTC and another user wants to trade BTC for ETC. In this case, rather than each user waiting for another one to appear, with AMM protocol, exchanges create a pool of ETCs and BTCs and offer all the users to exchange ETCs with BTCs or vice versa through this pool. This pool is called a liquidity pool.

- Moreover, for decentralized exchange, an AMM will eliminate the input of third parties so that users can execute trades directly from their personal wallets.

How Automated Market Maker(AMM) Work?

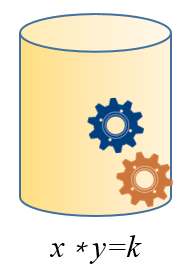

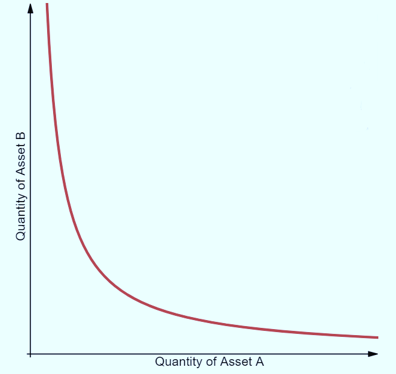

- The algorithm of Automated Market Maker(AMM) is based on the supply and demand theory of economic. That is the formula of x*y=k(where X denotes the value of Asset A and Y represents that of Asset B. K is a constant value), an automated market maker uses it to dictate the pricing of assets against each other.

- For example, the pool creator can set one ETH and one LTC are worth the same i.e., $1. Let's make a pool of 200ETH and 200 LTC, so the constant "k" is 200*200=40000. If a user wants to sell 50 ETH for LTC, "x " will be 200+50=250, to keep the k constant, we need to change the value of "y", so "y" will be 40000/250=160. Hence we can conclude that the price of LTC has now increased to $1.5625 (250/160) whereas the ETH has fallen to $0.64 (160/250) as per the demand and supply.

- In conclusion, the more LTC is bought by traders, the higher the value of LTC. ETH would experience an opposite price movement all to ensure that the product of the value of both tokens equals a constant. The algorithm automatically dictates the prices of assets depending on the demand.

Stay tuned to CoinCarp Social Media and Discuss with Us:

X (Twitter) | Telegram | Discord | Reddit

Download CoinCarp App Now: https://www.coincarp.com/app/

$30,000 Deposit Blast-Off

Sponsored

Earn up to $30,000 when you make your first deposit and trade on Bybit! Register Now!